1031 For an LLC Co-Owned Investment Property: Check If Opinions on a 1031 Exchange are Divided

You’ve built a fantastic real estate portfolio with your partners, and everything’s been smooth sailing. But now it’s time to sell a property, and you’ve hit a major snag. You see a golden opportunity to roll the profits into a new deal using a tax-deferred 1031 exchange, but your partners have other plans—they just want to take the cash and run. Suddenly, you’re facing a classic partnership standoff that could leave you stuck with a huge, unexpected tax bill. This isn’t just a hypothetical problem; it’s a real trap that many investors fall into, but don’t worry, there’s a clever way out! 😊

First, What Is a 1031 Like-Kind Exchange? 🤔

Before we dive into the solution, let’s have a quick refresher on the tool at the heart of this issue: the 1031 exchange. Named after Section 1031 of the U.S. Internal Revenue Code, a “like-kind” exchange is a powerful tax-deferral strategy for real estate investors.

In simple terms, it allows you to sell an investment property and reinvest the proceeds into a new, “like-kind” property without having to pay capital gains taxes on the sale immediately. You’re not avoiding taxes forever, but rather kicking the tax can down the road. This allows you to use your entire pre-tax profit to acquire a larger or better property, significantly accelerating your portfolio’s growth.

The Power of Tax Deferral

The impact of this deferral is massive. Imagine a property you bought years ago for $100,000 is now worth $1,000,000. That’s a $900,000 capital gain! Normally, Uncle Sam would take a hefty slice of that profit. With a 1031 exchange, you can reinvest the full million, keeping your money working for you.

| Metric | Amount | Tax Status |

|---|---|---|

| Original Price (Basis) | $100,000 | N/A |

| Sale Price | $1,000,000 | N/A |

| Capital Gain | $900,000 | DEFERRED |

There’s a critical rule for 1031 exchanges: the taxpayer who sells the original property must be the exact same taxpayer who buys the replacement property. This “same entity” rule is why partnerships run into trouble. The LLC is the taxpayer, not the individual partners inside it.

The Partnership Trap: Why Simple Solutions Fail 📊

So, why can’t the partners who want cash just sell their shares of the LLC to the partners who want to continue? It seems like the most logical solution, right? Unfortunately, the IRS has very specific rules that make this a non-starter.

The core issue is that a 1031 exchange applies to the sale of real property—land and buildings—not financial instruments. The IRS considers an interest in a partnership or LLC to be personal property, similar to a share of stock. It is explicitly excluded from being eligible for a 1031 exchange.

If you try to mix a sale of partnership interests into a 1031 exchange, you risk poisoning the well for everyone. The IRS will likely disallow the entire exchange, forcing all partners—even those who wanted to defer—to pay capital gains taxes immediately. It’s a domino effect that can lead to a disastrous financial outcome.

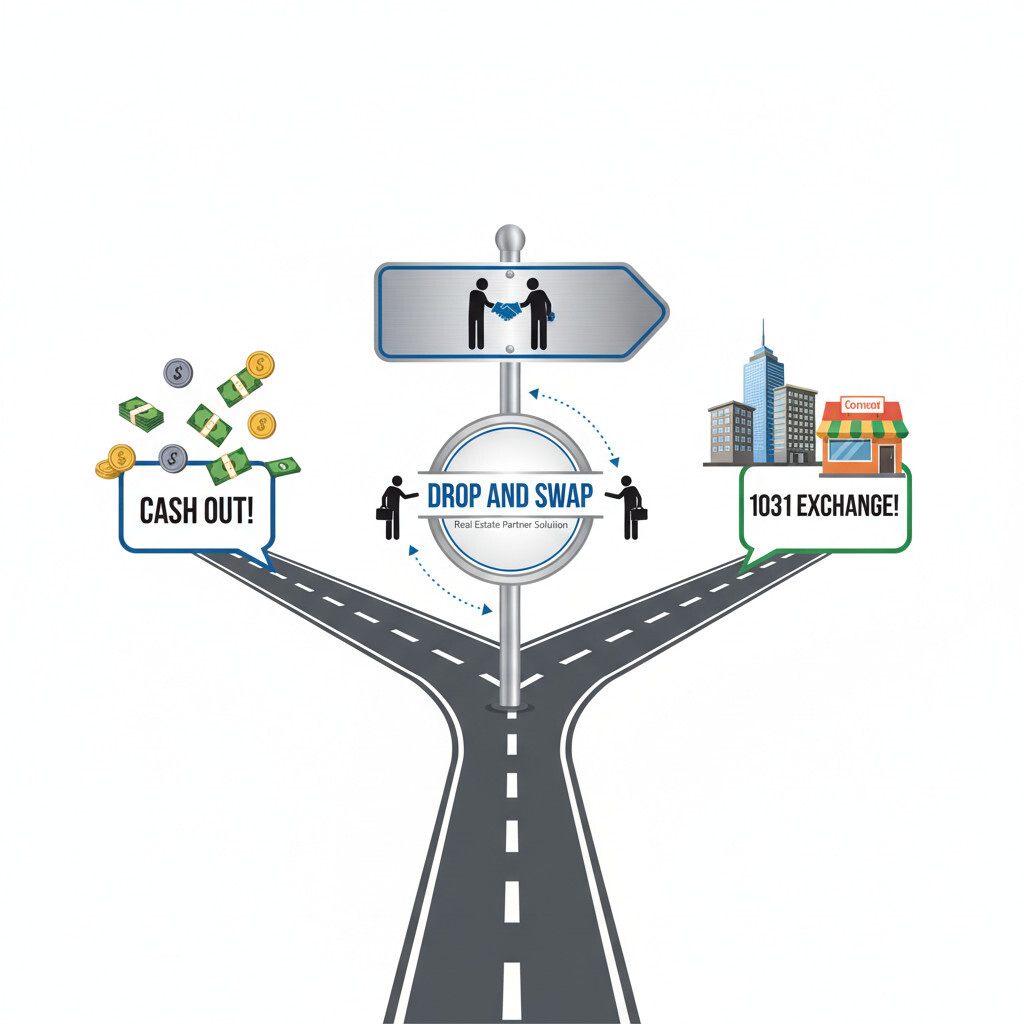

The ‘Drop and Swap’ Solution: An Expert Strategy 🧮

Since the easy answers are off the table, we need a more advanced strategy. This is where the pros turn to an elegant, multi-step process known as the “Drop and Swap.” It’s a method that allows each partner to go their separate ways while still following IRS rules.

The Three Steps of a Drop and Swap 📝

- Step 1: The DROP: The LLC is legally dissolved, and the property’s title is “dropped” down to the individual members. Each partner receives a fractional, direct ownership interest in the real estate itself, proportional to their share in the LLC.

- Step 2: Receive TIC Ownership: The partners now co-own the property as Tenants-in-Common (TIC). This is a crucial legal distinction. As a TIC, you own a direct piece of the real property, not just a share of a company that owns it.

- Step 3: The SWAP (or Sale): Now that each individual is a direct owner of real property, they are free to act independently. The partners who wish to reinvest can now perform their own 1031 exchanges with their fractional interest. The partner who wants to cash out can simply sell their share to a buyer and pay the taxes on their portion alone.

This structure elegantly solves the “same entity” problem. Each partner becomes their own taxpayer, free to make their own decision without affecting the others. Everybody wins!

Critical Rules You Cannot Ignore 👩💼👨💻

The Drop and Swap sounds like a magic bullet, but it comes with some very strict rules. Getting this wrong can invalidate the entire process, so this is the fine print you absolutely must follow.

The biggest hurdle is something called the “step transaction doctrine.” The IRS is smart; if it looks like you dissolved the LLC on a Monday just to sell the property on a Tuesday, they’ll view it as a single, pre-planned transaction designed solely to avoid taxes. They will argue that the property was never truly held for investment by the individual partners as TICs.

To prove to the IRS that you genuinely intended to hold the property as an investment as Tenants-in-Common, there must be a significant time gap between the “drop” and the “swap.” Most tax professionals recommend holding the property in the TIC structure for at least one to two years before selling or exchanging. Anything less is risky and could be challenged.

Entity Eligibility for Drop and Swap

It’s also crucial to know that this strategy doesn’t work for every type of business entity.

| Entity Type | Eligible? | Why? |

|---|---|---|

| LLC / Partnership | ✅ Yes | As “pass-through” entities, they can typically distribute property to owners without an immediate tax event. |

| Tenancy-in-Common (TIC) | ✅ Yes | This is the target ownership structure, already set up for individual action. |

| Corporation (C-Corp / S-Corp) | ❌ No | Distributing appreciated property from a corporation to its shareholders is itself a taxable event, defeating the purpose. |

Conclusion: Plan Your Exit from the Start 📝

The 1031 partnership standoff is a perfect example of why the legal structure you choose at the beginning of an investment can have massive consequences years down the line. While the Drop and Swap is a powerful solution, it requires foresight, patience, and careful planning.

It forces every real estate investor to ask a critical question: how should you structure your next group investment to ensure everyone has the freedom to choose their own path when it’s time to exit? Thinking about the end game from day one can save you from a world of tax headaches and partnership drama. If you have any questions about your own situation, feel free to ask in the comments~ 😊