The OBBB Act and Your Taxes: Don’t Miss Out on These Expiring Energy Credits (IRS Explanation)

Have you been thinking about buying an electric vehicle or making some energy-efficient upgrades to your home? Many of us plan these big purchases around the tax credits that make them more affordable. Well, I have some urgent news you’ll want to hear. A new piece of legislation, the “One, Big, Beautiful Bill Act” (OBBB), has moved up the timeline, and many of these popular credits are ending sooner than we all thought! It can be frustrating when the rules change, but don’t worry, I’ve gone through the latest IRS guidance to figure it all out for you. 😊

What is the OBBB Act and How Does It Affect You? 🤔

Recently, the “One, Big, Beautiful Bill Act,” also known as OBBB, was passed into law. While the bill covers many areas, one of its most significant impacts for everyday taxpayers is the accelerated termination of several energy credits and deductions. This means the window of opportunity to take advantage of these savings is now smaller.

If you’ve been putting off a purchase, now is the time to pay close attention. These changes affect everything from new and used electric vehicles to solar panel installations and energy-efficient home improvements. Let’s look at the specific deadlines.

This information is based on the latest guidance from the IRS (FS-2025-05) released in August 2025. While these FAQs provide clarity, the law itself will always be the final word in any specific case.

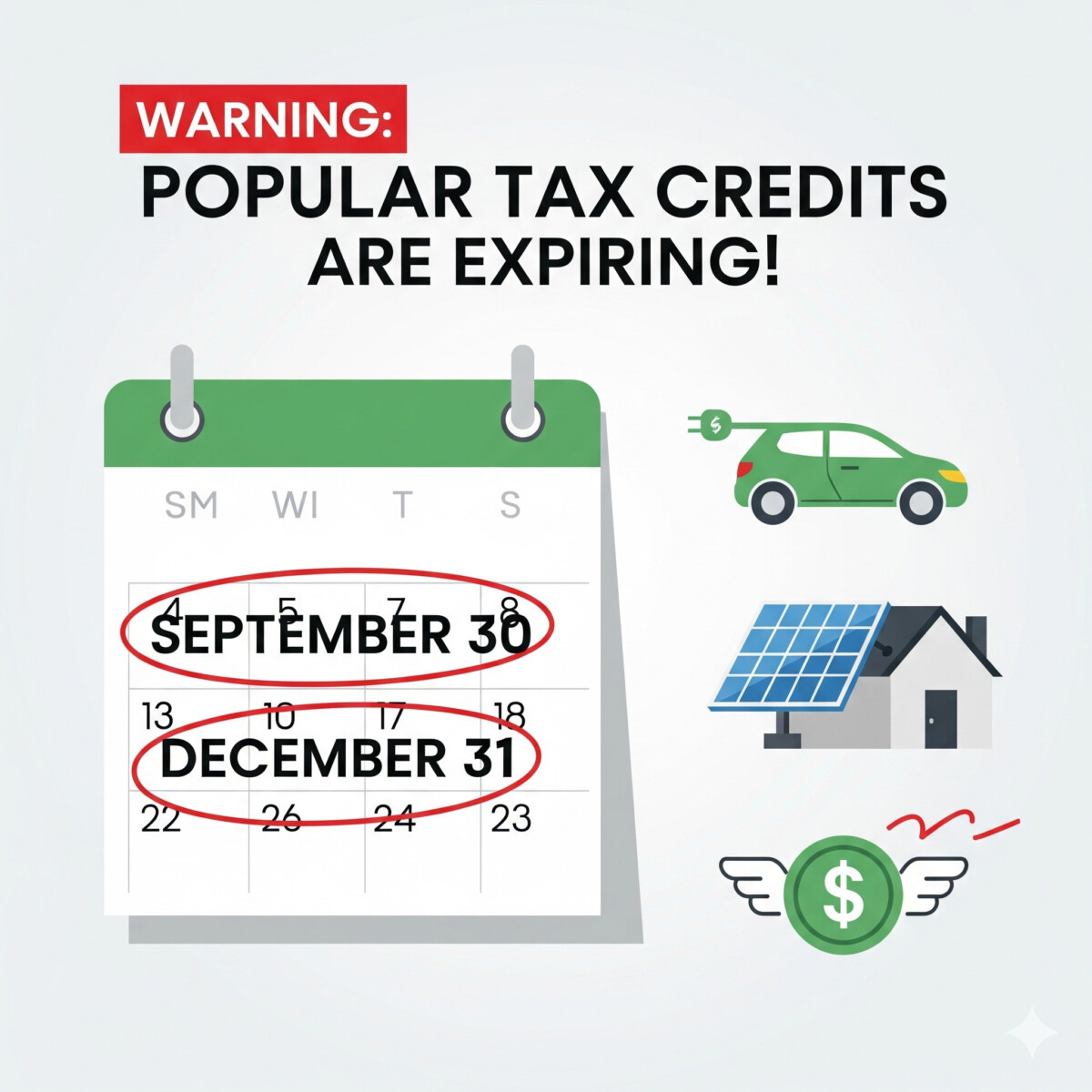

New Expiration Dates You MUST Know 🗓️

To make it easy to see how you might be affected, I’ve put together a table with the key credits that are ending early. Find the credits relevant to you and take note of the new termination dates!

| Credit / Deduction (Section) | What It’s For | New Termination Date |

|---|---|---|

| New Clean Vehicle Credit (30D) | New electric, plug-in hybrid, and fuel cell vehicles. | Vehicles acquired after September 30, 2025, are not eligible. |

| Previously-Owned Clean Vehicles Credit (25E) | Used clean vehicles from a dealer. | Vehicles acquired after September 30, 2025, are not eligible. |

| Qualified Commercial Clean Vehicle Credit (45W) | Clean vehicles for business use. | Vehicles acquired after September 30, 2025, are not eligible. |

| Energy Efficient Home Improvement Credit (25C) | Exterior doors, windows, insulation, and other qualifying improvements. | Property placed in service after December 31, 2025, is not eligible. |

| Residential Clean Energy Credit (25D) | Solar, wind, geothermal, and other renewable energy property. | Expenditures made after December 31, 2025, are not eligible. |

| Alternative Fuel Vehicle Refueling Property Credit (30C) | Home or business chargers for EVs and other alternative fuels. | Property placed in service after June 30, 2026, is not eligible. |

Vehicle Credits: “Acquired” vs. “Placed in Service” 🚗

For the vehicle credits (30D, 25E, and 45W), the deadline of September 30, 2025, is based on when the vehicle is “acquired.” This has a very specific meaning. According to the IRS, a vehicle is considered “acquired” when you enter into a written binding contract and have made a payment. A payment can be a nominal downpayment or even a vehicle trade-in.

This is great news if you’re waiting for a factory order! As long as you have that binding contract and have made a payment by the deadline, you are still entitled to claim the credit when you eventually take possession of the vehicle, even if that happens after September 30, 2025.

Acquiring the vehicle is just the first step. You can only formally claim the credit once the vehicle is “placed in service,” which means when you take possession. Similarly, if you plan to transfer your credit to the dealer for an upfront discount, you must make that election at the time of sale (when you take possession), not when you first sign the contract.

Key Details for Homeowners 🏡

For homeowners, the rules are a bit different. The Residential Clean Energy Credit (Sec 25D) for things like solar panels has a deadline of December 31, 2025. Crucially, the IRS states that an expenditure is considered “made” when the original installation of the item is completed.

Example: Solar Panel Installation 📝

Let’s say you sign a contract and pay for a full solar panel system on December 15, 2025. However, due to scheduling, the installation company doesn’t finish the job until January 10, 2026.

Result: Unfortunately, because the installation was completed after the December 31, 2025, deadline, you would not be eligible to claim the credit. The payment date doesn’t matter; the completion date does.

Key Takeaways of the Post 📝

I know this is a lot to take in, so here’s a quick summary of the most important points:

- A New Law is in Effect: The OBBB Act has caused several popular energy tax credits to end earlier than originally planned.

- Vehicle Credit Deadline: To be eligible for the new, used, or commercial clean vehicle credits, you must “acquire” the vehicle (have a binding contract and make a payment) on or before September 30, 2025.

- Home Credit Deadlines: For the home improvement and residential clean energy credits, the property must be placed in service or the installation must be completed by December 31, 2025.

- Act Now: If you were considering making an eligible purchase, you should evaluate your timeline immediately to avoid missing out on these valuable tax savings.

OBBB Act: Key Deadlines

Frequently Asked Questions ❓

Navigating tax law changes can be tricky, but knowing these new deadlines is the first step to making smart financial decisions. I hope this guide helps you plan accordingly. If you have any more questions, feel free to drop them in the comments below! 😊