Is an S Corp Right for You? A Complete Breakdown of Tax Benefits

Have you ever looked at the money in your business bank account and felt a little scared to touch it? You’re not alone. Many S Corp owners wonder, “If I move this to my personal account, will the IRS come knocking?” Or maybe you’ve had that heart-stopping moment when you get your tax return from your accountant, see a huge income number, and think, “Wait a minute… I never actually *received* all that money!” It can feel like you’re paying taxes on ghost money, and it’s natural to wonder if your accountant made a massive mistake. Trust me, these are incredibly common questions, and by the end of this article, you’ll have the answers and the confidence to manage your S Corp finances like a pro. 😊

What Is an S Corp, Really? (It’s Not What You Think) 🤔

First things first, let’s clear up the biggest misconception about S Corps. An S Corporation is not a type of business entity you form with the state, like an LLC or a C Corporation. Instead, it’s a tax election. You first form an LLC or a C Corp, and then you file a special form with the IRS (Form 2553) to ask them to tax your business *as* an S Corp.

Why does this matter? Because this election changes how your business profits are taxed. The S Corp gets its name from Subchapter S of the Internal Revenue Code, which allows it to be a “pass-through” entity. This means the business itself doesn’t pay corporate income tax. Instead, the profits and losses are “passed through” directly to the owners’ personal tax returns, and the owners pay the tax at their individual income tax rates. This simple change is the key to all of the S Corp’s powerful benefits.

Because the S Corp is a tax status, not a legal structure, you still get the liability protection of your underlying LLC or corporation. You’re simply choosing a more efficient way to be taxed!

The S Corp’s Superpower: Avoiding Double Taxation 🛡️

The number one reason business owners choose the S Corp election is to avoid a nasty problem called double taxation. This is what happens with a traditional C Corporation.

Here’s how the C Corp tax trap works:

- Tax #1 (Corporate Level): The corporation earns a profit and pays corporate income tax on it.

- Tax #2 (Personal Level): When the corporation distributes the remaining profits to the owners as dividends, the owners have to pay personal income tax on that same money *again*.

It’s a brutal one-two punch from the taxman. The S Corp, however, completely sidesteps this issue. Since all profits pass through to the owners, the money is only taxed once at the personal level. This is a massive advantage for small businesses.

| Feature | C Corporation (Default) | S Corporation (Election) |

|---|---|---|

| Corporate Tax | Yes, pays corporate income tax. | No, profits “pass-through” to owners. |

| Taxation on Profits | Taxed twice (corporate & personal). | Taxed once (personal only). |

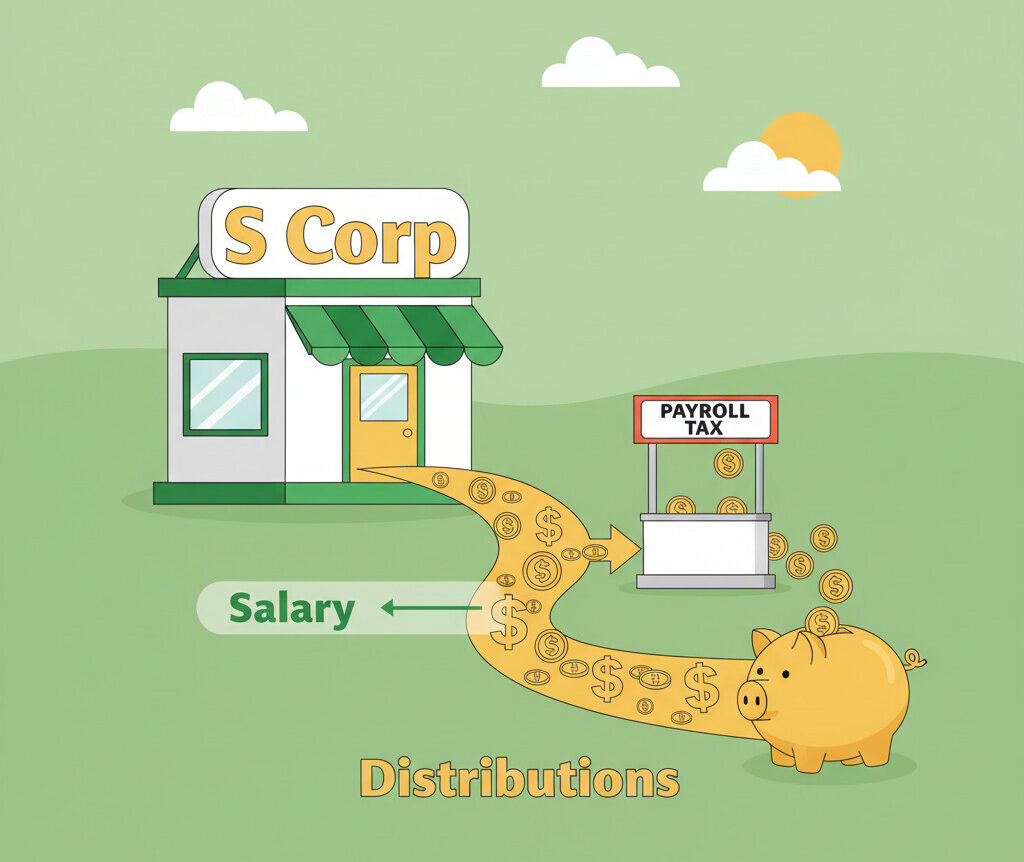

Salary vs. Distributions: The Core S Corp Strategy 💰

Alright, now we get to the real magic of the S Corp. Avoiding double taxation is great, but the strategy that saves business owners the most money involves splitting your income into two categories: a reasonable salary and distributions.

As an owner who also works in the business, the IRS requires you to pay yourself a “reasonable salary” for the work you do. This salary is subject to regular income tax AND payroll taxes (Social Security and Medicare), which total a hefty 15.3%. However, any remaining profits beyond that salary can be taken as a distribution. And here’s the key: distributions are NOT subject to that 15.3% payroll tax.

The term “reasonable salary” is crucial. You can’t pay yourself a $1 salary and take the rest as a distribution to avoid all payroll taxes. The IRS requires your salary to be comparable to what you’d pay someone else to do your job. It’s best to consult with a tax professional to determine a defensible salary for your role and industry.

A Real-World Savings Example 🧮

Let’s put this into perspective with an example. Meet Hong Gildong, a freelance consultant whose S Corp made $100,000 in profit this year.

Hong Gildong’s S Corp Profit Breakdown

- Total Profit: $100,000

- Reasonable Salary: $40,000 (Subject to income & payroll taxes)

- Distributions: $60,000 (Subject to income tax ONLY)

Payroll Tax Savings Calculation

By taking $60,000 as a distribution instead of a salary, Hong Gildong avoids the 15.3% payroll tax on that amount.

1) Calculation: $60,000 (Distribution) × 0.153 (Payroll Tax Rate) = $9,180

→ Final Result: Hong Gildong saves $9,180 in taxes in a single year, just by using this one strategy!

This is exactly why so many small business owners and freelancers get excited about the S Corp election. That’s a significant amount of money that stays in your pocket.

Advanced S Corp Tax-Saving Hacks 🚀

The salary-distribution split is the main event, but there are other powerful strategies you can use to maximize your savings.

| Strategy | How It Works | Tax Benefit |

|---|---|---|

| Health Insurance Premiums | The S Corp pays for your health insurance premiums. | The company gets a business deduction, and you can deduct it on your personal return. |

| Hiring Your Children | Pay your kids a reasonable wage for legitimate work they perform for the business. | The business gets a tax deduction, and the income is taxed at your child’s much lower tax rate. |

| Home Office Reimbursement | Instead of a simple deduction, create a formal “accountable plan” where the S Corp reimburses you for the business portion of your home expenses (utilities, internet, etc.). | The business gets a deduction, and the reimbursement money you receive is 100% tax-free to you. |

| The “Augusta Rule” Home Rental | Have your S Corp formally rent your home from you for legitimate business meetings (e.g., shareholder meetings, strategic planning sessions) for up to 14 days per year. | The S Corp gets a business deduction for the rent, and because you rented your home for 14 days or less, the rental income you receive is completely tax-free. It’s a fantastic win-win! |

S Corp Key Takeaways

Frequently Asked Questions ❓

The S Corp is more than just a boring tax form; it’s a strategic plan to build your wealth more efficiently. By understanding these core principles, you can make informed decisions that have a real impact on your bottom line. If you have any more questions, feel free to ask in the comments~ 😊