ASU 2025-07 Deep Dive: Understanding the New FASB Rules for Derivatives

Let’s be real, seeing a new FASB Accounting Standards Update (ASU) drop can make any finance professional’s heart skip a beat (and not always in a good way!). We all have to wonder: “How much is this going to change things? Is this another weekend lost to research?” Well, a new update, ASU 2025-07, was just issued, and it’s definitely one to pay attention to.

It targets two specific, and often complex, areas that have caused some confusion and diversity in practice. If you deal with complex contracts, R&D funding, or revenue contracts that involve things like stock or warrants, this post is for you. We’re going to unpack this new guidance in plain English, so you can feel confident about what’s changing. 😊

What is ASU 2025-07 All About? 🤔

This new update, officially named “Derivatives Scope Refinements and Scope Clarification for Share-Based Noncash Consideration from a Customer in a Revenue Contract,” isn’t a complete overhaul of accounting as we know it. Thank goodness, right? Instead, it’s a targeted fix for two distinct issues:

- A New Derivative Scope Exception: It refines Topic 815 (Derivatives) by adding a new exception. This is designed to stop certain contracts, which don’t really *feel* like derivatives, from being accounted for as derivatives. The goal here is to reduce the cost and complexity of accounting for these specific contracts.

- A Clarification on Share-Based Payments: It clarifies the “order of operations” for accounting for share-based noncash consideration (like stock or options) received from a customer in a revenue contract. This is all about ensuring everyone follows the same playbook, primarily starting with Topic 606 (Revenue Recognition).

The FASB issued this to address concerns from stakeholders (that’s us!) and hopefully make financial statements better reflect the economics of these deals. So, let’s dive into the first part.

Deep Dive 1: The New Derivative Scope Refinement 📈

The “D-word” (derivative) can make even seasoned accountants pause. The rules in Topic 815 are broad, and sometimes they pull in contracts that are really more operational than financial. This ASU tries to fix that.

It introduces a new scope exception from derivative accounting. A contract can now be excluded if it meets two key conditions:

- The contract is not exchange-traded. (This is pretty straightforward.)

- The contract has one or more underlyings based on operations or activities specific to one of the parties in the contract.

What does “specific to one of the parties” mean? Think of things like:

- Achieving a product development milestone (e.g., finishing Phase 3 trials).

- Obtaining regulatory approval (e.g., getting FDA approval for a new drug).

- Achieving a specific earnings measure from a particular product line.

This change could be huge for certain industries. Think about research and development (R&D) funding arrangements, litigation funding, or even some of those popular environmental-, social-, and governance-linked (ESG) bonds where interest payments might change based on a company hitting its own sustainability targets.

However, this new exception has its own exceptions. (It wouldn’t be accounting without exceptions to the exceptions, right?)

This new rule is targeted, so you can’t use it for everything. It doesn’t apply if the underlying is based on:

- A market rate, market price, or market index.

- The price or performance of a financial asset or financial liability of one of the parties.

- Contracts involving an entity’s own equity (which have their own rules in Topic 815-40).

- Certain call and put options on debt instruments.

Practical Example: R&D Funding

The Scenario 📝

Let’s use the example from the guidance. Entity A (a biotech) enters an R&D funding arrangement with Entity B (an investor).

- Entity B gives Entity A $50 million in funding to develop a new drug.

- In return, Entity A agrees to make two potential future payments to Entity B:

- Payment 1: $20 million upon regulatory approval of the drug.

- Payment 2: $80 million when the drug’s gross profit exceeds $500 million.

The Accounting (After ASU 2025-07)

Before this ASU, an entity might have had to argue (or conclude) that these payment features were derivatives that needed to be bifurcated and fair valued every single quarter. What a nightmare!

Now, under ASU 2025-07, both underlyings—(1) regulatory approval and (2) achieving the gross profit measure—would qualify for the new scope exception. Why?

- The contract isn’t exchange-traded.

- Both underlyings are based on events specific to Entity A’s own operations (developing and selling its drug).

- They don’t fall into any of the “Heads Up” exceptions listed above (they aren’t based on a market price, etc.).

This means the contract likely wouldn’t be a derivative, and the accounting would be much, much simpler. This is a big win for simplifying things.

Deep Dive 2: Clarification on Share-Based Payments 🧾

The second part of the ASU tackles a different problem: accounting for share-based noncash consideration (think shares, warrants, options) that you receive *from a customer* as part of a revenue contract.

The big question has always been: “Which guidance do I apply first? Topic 606 (Revenue), Topic 815 (Derivatives), or Topic 321 (Equity Securities)?” This lack of clarity led to… you guessed it… diversity in practice.

The ASU provides a clear answer: You must apply Topic 606 first.

You follow all the noncash consideration and variable consideration guidance within Topic 606 to determine your transaction price (using the fair value of the share-based payment at contract inception) and recognize revenue as you satisfy your performance obligations.

Only when your right to receive or keep that share-based consideration becomes unconditional under Topic 606 do you then “switch” and apply other guidance like Topic 815 or Topic 321. An “unconditional” right means only the passage of time is required before payment is due, and it’s not tied to any more performance from you.

How to Handle Value Changes (This is Key!)

Under Topic 606, there’s a critical distinction for noncash consideration. This is where it gets a little tricky:

| If the fair value varies due to… | Accounting Treatment (under Topic 606) |

|---|---|

| The form of the consideration (e.g., the customer’s stock price goes up or down) |

The transaction price is NOT adjusted. You stick with the fair value measured at contract inception. |

| Reasons other than the form (e.g., a performance bonus changes the *number* of shares you’ll receive) |

This IS reflected in the transaction price and is subject to the guidance on constraining variable consideration. |

Practical Example: The Warrant Bonus

The Scenario 📝

You enter a one-year contract to sell Product A to a customer for $1 per unit. There’s a performance bonus: if you deliver 1,000 units during the year, the customer will give you 100 warrants in their common stock.

The Accounting (After ASU 2025-07)

1. Apply Topic 606 First: You apply all the revenue rules. The 100 warrants are variable consideration.

2. Estimate the Bonus: At contract inception, you measure the fair value of the 100 warrants. Let’s say you believe it’s *most likely* you’ll meet the 1,000-unit threshold. You’d include this estimated bonus value in your total transaction price (as long as it’s not probable a significant revenue reversal will occur).

3. Recognize Revenue: As you deliver each unit (say, unit 1, unit 2, … unit 700), you recognize a portion of that warrant bonus as revenue and record a *contract asset*. Remember, you don’t adjust this value just because the customer’s stock price is fluctuating (that’s a change due to “form”).

4. The “Switch”: You finally deliver the 1,000th unit. *NOW* your right to the warrants is unconditional. At this exact moment, you stop applying the Topic 606 contract asset model to the warrants and start applying other guidance (like Topic 815 or 321) to the warrants you now hold or are owed.

The ASU clarifies the *order* of accounting, but it leaves one part a bit fuzzy. While you’re building up that *contract asset* (in step 3 above), what happens if the customer’s stock price plummets, making the warrants (your noncash consideration) less valuable?

Topic 326 covers impairment for *credit loss* on a contract asset, but not impairment due to a drop in value from the *form* of the consideration. The FASB noted this… and then didn’t provide specific guidance on how to apply an impairment model. This means we might see… (say it with me)… *diversity in practice* on this specific point. It’s something to be aware of and discuss with your auditors.

When Does This Start? (Effective Dates & Transition) 🗓️

This isn’t happening tomorrow, but it’s on the horizon. The ASU is effective for all entities for interim and annual periods in fiscal years beginning after December 15, 2026.

However, early adoption is permitted for any financial statements that haven’t been issued yet. If you’ve been struggling with one of these issues, you might want to consider adopting early.

When you do adopt, you have two choices for transition, and you can even pick different methods for the two different issues in the ASU (the derivative part and the share-based payment part).

Transition Methods

| Method | How it Works |

|---|---|

| Prospective Basis | Apply the new guidance only to new contracts entered into (or modified) on or after the date you adopt the ASU. |

| Modified Retrospective Basis | Apply the guidance to contracts that exist as of the beginning of the annual period you adopt, and record a one-time cumulative-effect adjustment to your opening retained earnings. |

Required Disclosures

As with any accounting change, you’ll need to tell your investors what you did. The disclosures are required in the period of adoption:

| If you chose… | You must disclose… |

|---|---|

| Prospective | The nature of and reason for the change in accounting principle. |

| Modified Retrospective |

|

Key Takeaways of the Post 📝

Whew, that was a lot, but you made it! Here’s a quick summary of what we’ve learned about ASU 2025-07:

- A New Exception for Derivatives: This is the big one. If you have contracts (that aren’t exchange-traded) with payments tied to your *own* specific operational milestones (like R&D or regulatory approval), they may no longer be considered derivatives under Topic 815. This is a potential simplification win!

- Check Your Contracts: You’ll want to review R&D funding, litigation funding, and ESG-linked contracts to see if this new exception applies. It could change your accounting.

- Topic 606 Comes First: For share-based payments (stock, warrants, etc.) received *from a customer*, the rule is now crystal clear: you apply Topic 606 (Revenue Recognition) first, including its rules for noncash and variable consideration.

- The “Unconditional” Trigger: You only apply other guidance (like Topic 815 or 321) to those share-based payments *after* your right to them is unconditional under Topic 606 (i.e., you’ve done your part of the job).

- One Fuzzy Spot: Be aware of the lack of clarity around “form-based” impairment for contract assets related to share-based payments. This is a key area to watch and discuss with your auditors.

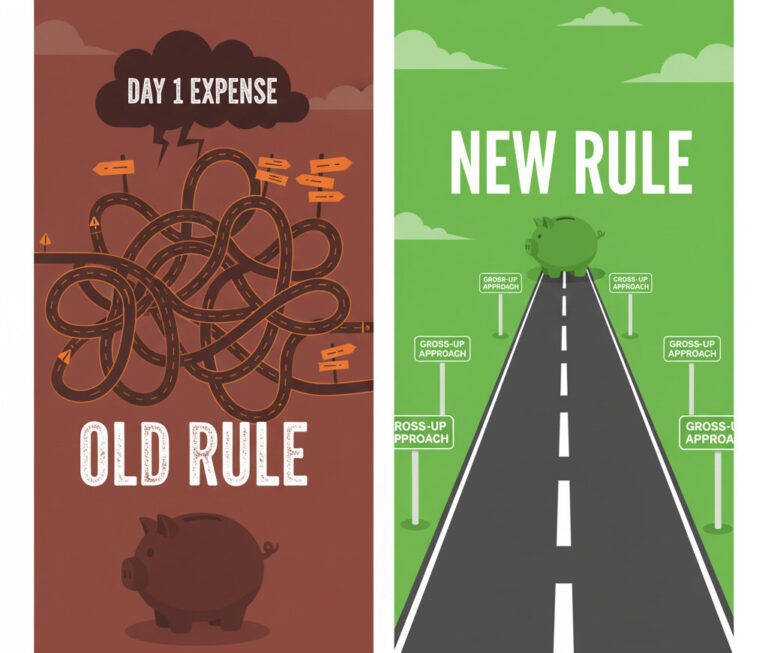

ASU 2025-07 in a Nutshell

Frequently Asked Questions ❓

This new guidance is a welcome step toward simplification in some very complex areas. As always, the devil is in the details, so be sure to review your specific contracts and fact patterns. If you have any more questions, feel free to ask in the comments~ 😊