FASB Updates Government Grants Accounting: What Business Entities Need to Know

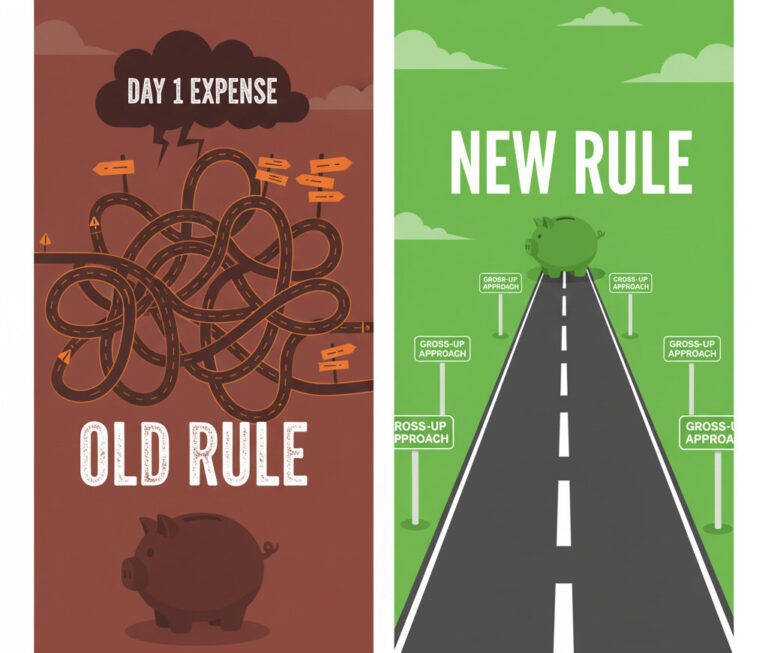

To be honest, if you’ve ever had to account for a government grant as a business entity, you probably felt like you were navigating a maze without a map. 🗺️ For decades, we’ve had to “borrow” guidance from international standards (IAS 20) or non-profit rules because U.S. GAAP simply didn’t have a specific chapter for businesses receiving government cash or assets. It was a bit of a “choose your own adventure” situation, which, let’s be real, is a nightmare for comparability.

But guess what? The wait is over! The FASB has officially issued Accounting Standards Update (ASU) No. 2025-10, Government Grants (Topic 832). This is huge news for CFOs, controllers, and accountants everywhere. We finally have a dedicated standard that tells us exactly when to recognize a grant, how to measure it, and where to put it on the financial statements. No more guessing games! 😊

In this guide, I’m going to walk you through everything you need to know about this new standard—from the “probable” threshold to the nitty-gritty of the “cost accumulation approach.” Let’s dive in!

1. Who is this for? (Scope and Exclusions) 🎯

First things first, does this apply to you? If you run a business entity (basically, any entity that isn’t a non-profit or an employee benefit plan) and you receive a transfer of assets from the government, listen up.

The standard defines a government grant as a transfer of a monetary asset (like cash) or a tangible nonmonetary asset (like land or a building) from a government to a business entity. However, it’s not a free-for-all. The FASB was very specific about what is not included to keep things manageable.

The definition of “Government” here is quite broad! It includes domestic, foreign, local (city/county), regional, and national governments, plus related agencies and commissions. So, whether it’s a federal grant or a subsidy from your local municipality, it likely falls under this umbrella.

Here is what is EXCLUDED from this new standard:

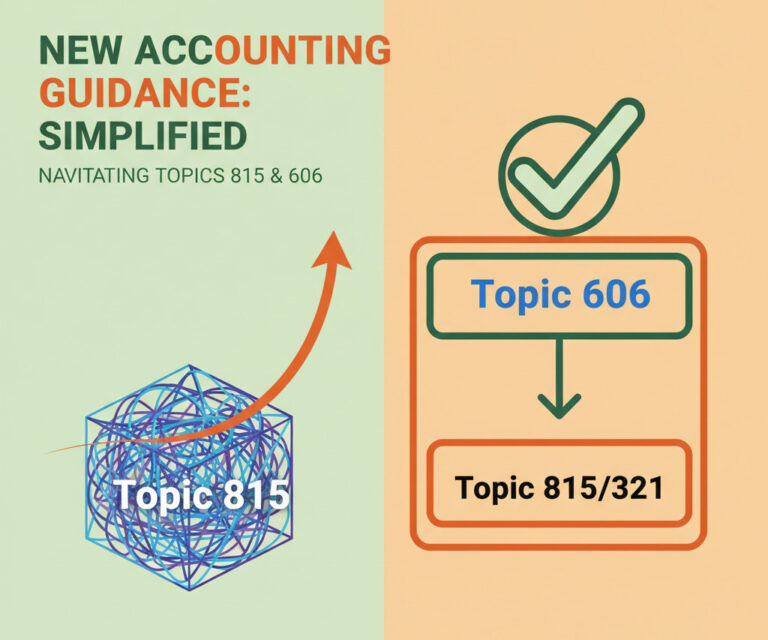

- Income Taxes: Anything related to tax credits or tax liability (Topic 740) is out.

- Exchange Transactions: If you are providing goods or services to the government in exchange for payment (even at a discount), that’s revenue (Topic 606), not a grant.

- Below-market interest rate loans: The benefit you get from a cheap government loan isn’t accounted for as a grant here.

- Government Guarantees: These remain under their own separate guidance.

2. The “Probable” Threshold: When to Recognize? 🤔

This is arguably the most critical part of the new standard. When can you actually put that grant on your books? If you’ve been using IAS 20 by analogy, you’re used to the term “reasonable assurance.” Well, FASB decided to go with a term that U.S. accountants are much more familiar with: Probable.

Under ASU 2025-10, you cannot recognize a grant until it is probable that:

- Your entity will comply with the conditions attached to the grant; AND

- The grant will be received.

Just getting the cash isn’t enough! If there are strings attached (conditions), you have to be probable to meet them. And conversely, even if you meet the conditions, you have to be probable to actually get the money.

Be careful with timing! The standard says a grant receivable or liability might be recognized because of timing differences. For example, if you receive cash before meeting the “probable” compliance threshold, that’s a liability (not revenue) until you meet the criteria.

3. Accounting for Grants Related to Assets 🏗️

Let’s say the government gives you money specifically to build a factory or buy new machinery. This is a “Grant Related to an Asset.” The FASB has given us two ways to handle this, and honestly, having options is nice, but it requires a strategic choice.

You can choose between the Deferred Income Approach and the Cost Accumulation Approach. Here is how they stack up:

| Method | How it Works (Balance Sheet) | Impact on Earnings |

|---|---|---|

| Deferred Income Approach | Record the asset at full cost. Record the grant as a liability (Deferred Income). | Recognize income systematically over the asset’s useful life (offsetting the expense). |

| Cost Accumulation Approach | Deduct the grant amount from the asset’s carrying value. (Asset looks cheaper). | Lower depreciation expense over the asset’s life. No separate “grant income.” |

If you choose the Cost Accumulation Approach, remember that you won’t see a line item for “Grant Income” on your P&L. Instead, your depreciation expense will just be lower than normal. It’s a cleaner look for some, but others prefer the transparency of the Deferred Income Approach.

📝 Example: The Solar Panel Grant

Imagine you buy solar panels for $100,000 and receive a government grant for $20,000.

- Deferred Income: Asset = $100k, Deferred Income = $20k. You depreciate $100k over time and recognize $20k income over time.

- Cost Accumulation: Asset = $80k ($100k – $20k). You depreciate only $80k over time.

4. Accounting for Grants Related to Income 📉

What about grants that cover operating expenses, like payroll or R&D? These are “Grants Related to Income.”

The rule here is matching. You should recognize the grant in earnings on a systematic and rational basis over the periods where you recognize the related costs. Basically, don’t book all the income in January if the grant covers rent for the whole year.

Presentation Options on the Income Statement:

- Gross Presentation: Show the grant separately under a heading like “Other Income.”

- Net Presentation: Deduct the grant from the related expense. (e.g., If you have $50k wages and a $10k grant, you report $40k in wage expense).

🔢 Effective Date Checker

Unsure when you need to adopt this? Check your status below.

Key Takeaways: What You Must Remember 📝

This standard aims to bring consistency to U.S. financial reporting. Here is the cheat sheet:

- Standardization: No more analogizing to IAS 20. We now have Topic 832.

- Recognition Threshold: The magic word is “Probable.” If compliance and receipt are probable, you recognize it.

- Asset Grants: You can choose to record deferred income (liability) or reduce the asset’s cost basis.

- Tangible Assets: If the government gives you land or equipment, you can measure it at Fair Value (under deferred income) or Cost (under cost accumulation).

- Disclosures: You need to tell investors the nature of the grant, accounting policy used, and significant terms/conditions.

ASU 2025-10 Snapshot

Option B: Cost Accumulation (Reduce Asset Base)

Frequently Asked Questions ❓

It’s definitely a relief to finally have authoritative guidance in U.S. GAAP for government grants. While the “Cost Accumulation Approach” might be controversial to some because it “hides” the asset’s true cost, having clear rules reduces the headache of wondering if you’re doing it right. If you have any questions about how this might impact your specific industry, drop a comment below! 😊