4 Critical Social Security Mistakes That Can Cost You Tens of Thousands

Deciding when and how to claim Social Security is one of the most significant financial decisions you’ll ever make. With over 70 million Americans currently receiving benefits, you’d think the process would be straightforward. Unfortunately, it’s anything but. The system is notoriously complex, and a few simple misunderstandings can lead to life-altering financial losses. Have you worried about whether you’re making the right choice? You’re not alone. We’re here to walk you through the most common pitfalls and give you the knowledge to take control of your financial future. 😊

Why Is This So Difficult? A Six-Figure Problem 🤔

Why are these six-figure mistakes so common? In a word: complexity. The Social Security system was not designed with the user in mind. The entire program is governed by more than 2,700 different rules, and the official handbook is a staggering 20,000+ pages long. It’s no surprise that without a guide, people get lost and make costly errors.

This is precisely why experts like Boston University’s Laurence Kotlikoff issue a stark warning: “Do not rely on the Social Security Administration’s advice. You have to study this for yourself.” While SSA employees can tell you the rules, they can’t give you personal advice. Taking ownership of your decision is the only way to ensure you get the best outcome.

Knowledge is your best defense. The goal isn’t to become an expert on all 2,700 rules, but to understand the key decisions that have the biggest impact on your lifetime benefits. That’s what we’ll focus on here.

Mistake #1: Claiming Early (The High Price of Impatience) ⏳

The first and by far the most common mistake is claiming benefits at the earliest possible moment: age 62. It’s incredibly tempting to get that money flowing, but that decision comes with a very heavy and permanent price tag.

Your monthly benefit amount is determined by when you claim relative to your “Full Retirement Age” (FRA), which is 67 for most people today. Claiming early locks in a permanent reduction, while waiting earns you a significant bonus.

| Claiming Age | Lifetime Benefit (vs. Full Retirement Age) | Notes |

|---|---|---|

| Age 62 (Earliest) | Up to 30% permanent reduction | The most popular age, but often the costliest choice. |

| Age 67 (Full Retirement) | 100% of your benefit | The baseline for calculating your payments. |

| Age 70 (Latest) | Up to 108% of your benefit | Maximizes your monthly payment for life. |

You only get a 12-month window after you start collecting benefits to withdraw your application and “reset” your decision. After that, your choice is locked in for life. Alarmingly, the SSA sometimes advises people to claim early based on outdated life expectancy data, a suggestion that could cost a fortune.

Mistake #2: The Widow’s Trap (A Permanent Consequence) 💔

This next mistake is particularly tough because it often occurs during a time of incredible grief. It’s known as the “Widow’s Trap,” and it involves a critical misunderstanding of how survivor benefits work.

When a spouse passes away, the surviving spouse can choose between taking their own retirement benefit or taking the survivor benefit from their late spouse; you are entitled to whichever is higher. That sounds simple, but here’s where the trap is hidden.

Understanding the Survivor Benefit Choice

1) Compare: You have to compare your own retirement benefit against your late spouse’s survivor benefit.

2) Choose: You are entitled to the higher of the two amounts.

3) The Trap: The survivor benefit may be higher *today*, but your own benefit continues to grow every year you wait to claim it (up to age 70). If you claim the survivor benefit early, you could be locking yourself into a smaller payment for life and giving up the much larger benefit you could have had by letting your own continue to grow. This choice is permanent.

Mistake #3: Misunderstanding the Earnings Test 📝

Many people believe they can’t work and collect Social Security at the same time. This misunderstanding, which causes many to leave the workforce prematurely, stems from a rule called the Earnings Test.

The Earnings Test is a rule that only applies if you are under your full retirement age and still working while collecting benefits. If your income exceeds a certain limit, the SSA will temporarily withhold some of your benefit money. For example, in 2023, the limit was $21,240, and the SSA would withhold $1 for every $2 earned above that amount. People see this and think it’s a tax or a penalty for working. It’s not.

The Earnings Test is a Delay, Not a Penalty

Here’s the crucial piece everyone misses: the money withheld isn’t gone forever. The moment you reach your full retirement age, the SSA recalculates everything. They add the withheld money back into your future benefits, which results in a higher monthly payment for the rest of your life. Knowing this means you don’t have to stop working if you don’t want to!

Mistake #4: The Overpayment Nightmare 📨

Our final mistake is a strange one because it starts with an error made by the Social Security Administration, but you’re the one who ends up with the bill. This is the overpayment trap.

It may be hard to believe, but every year the SSA overpays more than a million people due to clerical errors. The real shock comes when, sometimes years down the road, you receive a letter demanding you repay tens of thousands of dollars you had no idea you weren’t supposed to receive. If this happens to you, do not panic. The SSA might demand it all back in 30 days, but you have rights. Your first step should be to request written proof of the debt and then work to arrange a repayment plan that actually fits your budget. Their mistake doesn’t have to become your financial crisis.

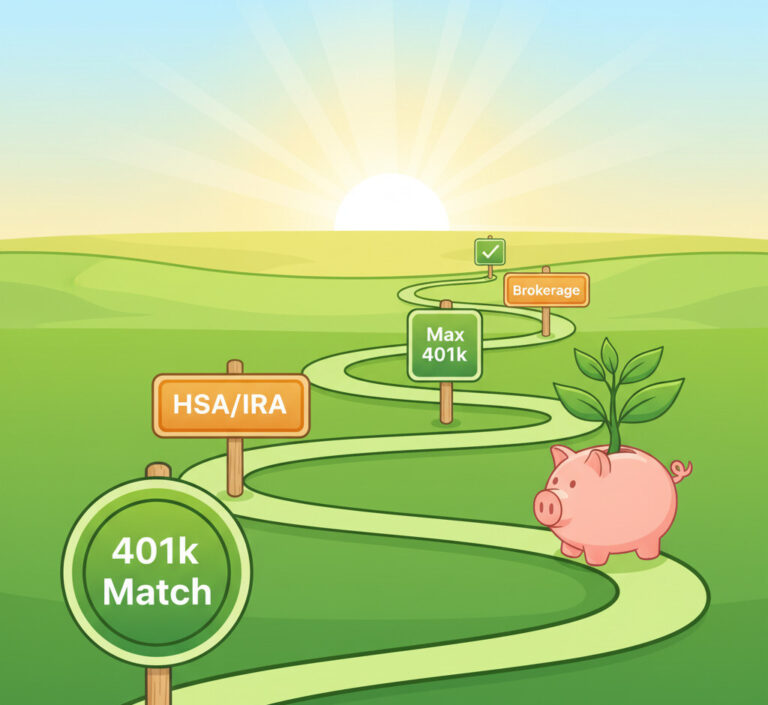

4 Keys to Maximize Social Security

Frequently Asked Questions ❓

You’ve worked your entire life for these benefits. The system is complex, but knowledge is power. By simply understanding and avoiding these common mistakes, you can ensure you get every single dollar you’ve earned. Are you confident you have a plan to get the most out of your benefits? Let us know your thoughts in the comments! 😊