US GAAP : Big Changes to Derivative & Revenue Accounting – FASB ASU 2025-07

Have you ever found yourself staring at a contract—maybe an ESG-linked bond or a complex R&D funding agreement—and thinking, “Is this *really* a derivative?” The accounting world has been grappling with this question as business transactions become more innovative. The old rules often felt too broad, forcing complex and costly accounting on arrangements that didn’t seem to fit. On a similar note, getting paid in company stock or warrants from a customer has created its own set of accounting puzzles. Well, the Financial Accounting Standards Board (FASB) has heard the feedback and is rolling out some much-needed clarifications with Accounting Standards Update (ASU) 2025-07. Let’s dive in and see how this update can make your life a little easier! 😊

What is FASB’s ASU 2025-07 All About? 🤔

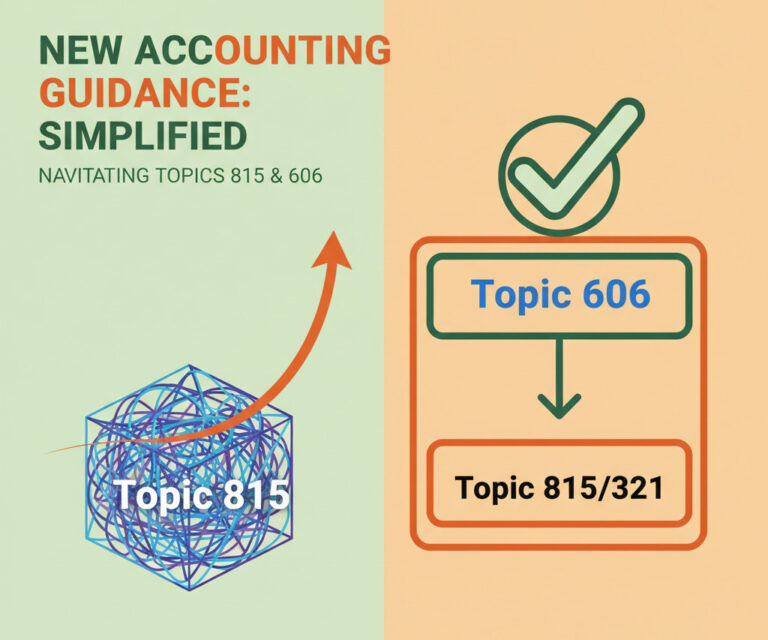

Issued in September 2025, ASU 2025-07 is an amendment to the FASB Accounting Standards Codification® that primarily targets two key areas: Derivatives and Hedging (Topic 815) and Revenue from Contracts with Customers (Topic 606). At its core, this update is designed to address concerns from stakeholders about the cost, complexity, and sometimes counterintuitive outcomes of current accounting standards in specific situations.

The update isn’t a massive overhaul but rather a “refinement” and “clarification.” It introduces changes that are expected to reduce the diversity in how companies account for certain transactions, making financial statements more comparable and better reflecting the true economics of the contracts. Essentially, FASB is trying to make the rules more practical and logical for today’s business environment.

The main goals of ASU 2025-07 are to:

- Reduce complexity and cost for companies evaluating certain contracts under derivative accounting rules.

- Provide clearer guidance on accounting for share-based noncash consideration from customers, reducing diversity in practice.

- Improve financial reporting so that it better portrays the economics of these specific contracts.

Issue 1: A Welcome Relief for Derivative Accounting (Topic 815) 📊

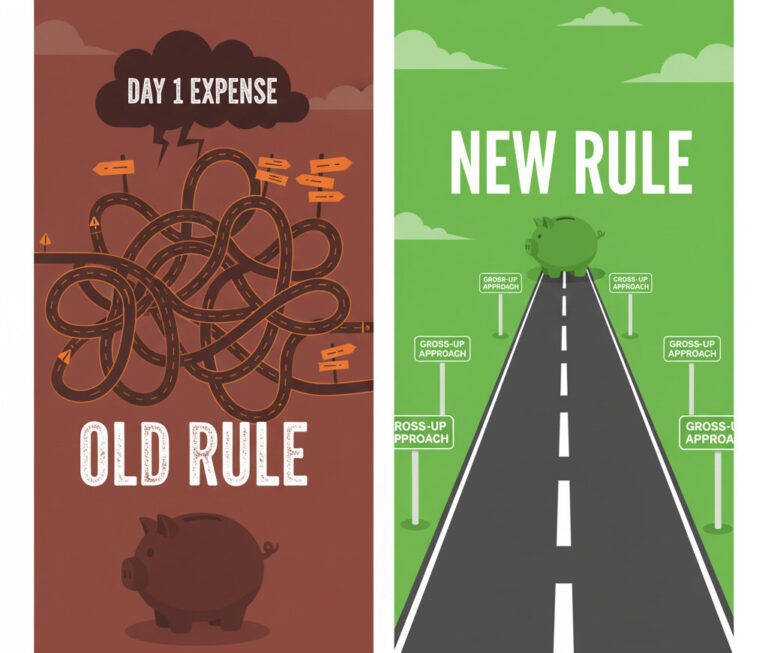

One of the biggest headaches in accounting has been the broad-stroke application of the definition of a derivative. Because the definition was so wide, many contracts, including emerging transactions like bonds with ESG-linked metrics, research and development (R&D) funding, and litigation funding arrangements, were potentially swept into the complex world of derivative accounting under Topic 815. Stakeholders argued that treating these contracts as derivatives often didn’t provide decision-useful information, especially when the contract’s outcome was tied to a company’s own performance.

FASB responded by expanding an existing scope exception. The new guidance excludes certain non-exchange-traded contracts from derivative accounting if their settlement is based on an “underlying” tied to the operations or activities specific to one of the parties in the contract. Think of the “underlying” as the variable that determines the payout. If that variable is your company’s own performance metric, it likely now falls under this exception.

What’s In vs. What’s Out of the Scope Exception

To make this clearer, let’s look at what kinds of contracts are now generally excluded from derivative accounting and which ones are still caught by the rules.

| Now Excluded from Derivative Accounting (Examples) | Still Considered Derivatives (Examples) |

|---|---|

| Underlyings based on a company’s own financial operating results, like EBITDA or net income. | Underlyings based on a market rate, market price, or market index (e.g., S&P 500, gold price). |

| The occurrence of an event specific to the company’s operations, like achieving a product development milestone or obtaining regulatory approval. | Underlyings based on the price or performance of a financial asset or liability, even if held by one of the parties (e.g., a credit default swap on a loan). |

| Payments contingent on meeting an internal target, such as a specified reduction in greenhouse gas emissions. | Contracts involving the issuer’s own equity that are evaluated under Subtopic 815-40. |

| Contracts with payments based on specified volumes of sales or service revenues of one of the parties. | Call options and put options on debt instruments. |

If a single contract has multiple underlyings—one that qualifies for the new exception (like hitting a sales target) and one that doesn’t (like a change in a commodity price)—you’ll need to apply the “predominant characteristics” assessment. This means you must determine if the contract, as a whole, behaves in a way that is highly correlated with the variable that does *not* qualify for the exception. This can require careful judgment!

📝 Practical Example: Sustainability-Linked Bond

Let’s put this into practice.

- The Situation: Green Corp issues a five-year bond. The bond’s terms state that if Green Corp fails to meet its publicly announced target of reducing greenhouse gas emissions by 20% by the end of year three, the interest rate on the bond will increase by 0.25% for the remaining term.

- The Accounting Question: Is the interest rate step-up feature an embedded derivative that needs to be bifurcated and accounted for separately at fair value?

- Analysis with ASU 2025-07: The “underlying” for the potential interest rate change is the failure to meet a greenhouse gas emissions reduction target. This is an activity specific to the operations and activities of Green Corp. It’s not based on a market price or index. Therefore, this feature falls squarely within the new scope exception in paragraph 815-10-15-59(e).

- Conclusion: Under ASU 2025-07, Green Corp would not need to separate the interest rate feature as a derivative. This significantly simplifies the accounting for the bond.

Issue 2: Clarifying Share-Based Payments in Revenue Contracts (Topic 606) 👩💼👨💻

The second part of the update tackles a growing area of uncertainty: how to account for share-based noncash consideration (like shares or warrants) received from a customer in exchange for goods or services. For example, if a consulting firm agrees to be paid partly in warrants of its startup client, but only after a project is successfully completed, when and how should that warrant income be recognized? Is it a derivative (Topic 815)? An investment (Topic 321)? Or part of the revenue contract (Topic 606)? This ambiguity led to different accounting treatments in practice.

ASU 2025-07 provides a clear pecking order: Topic 606 (Revenue from Contracts with Customers) comes first. You apply the guidance in Topic 606 to the share-based payment just as you would for cash or other noncash consideration. Other accounting guidance (like Topic 815 or 321) only applies *after* the company’s right to receive or keep the share-based payment becomes unconditional under Topic 606.

An “unconditional right” is established when the entity has fulfilled its performance obligations under the contract. At that point, only the passage of time may be required before the consideration is due. Contingencies related to the entity’s performance must be resolved before other GAAP topics can be applied to the share-based consideration.

📝 Practical Example: Warrants as a Performance Bonus

Let’s walk through an example from the ASU itself.

- The Situation: On Jan 1, 20X7, a Manufacturer enters a contract to sell 5,000 units to a Customer for $100 each. As a bonus, if all 5,000 units are delivered within two years, the customer will provide 100 warrants for its common stock. The warrants have an estimated fair value of $100,000 at contract inception. The Manufacturer expects to meet the delivery target.

- Transaction Price Calculation: The total transaction price is the cash consideration plus the noncash consideration (the warrants). The Manufacturer includes the $100,000 estimated fair value of the warrants, making the total transaction price $600,000. This allocates $120 to each of the 5,000 units.

- During 20X7: The Manufacturer delivers 3,000 units. It recognizes revenue of $360,000 (3,000 units x $120). It receives $300,000 in cash and recognizes a contract asset of $60,000 for the portion of the warrants earned. The transaction price is not updated for changes in the warrants’ fair value.

- At Completion: In 20X8, the remaining 2,000 units are delivered. The Manufacturer recognizes the remaining revenue and contract asset. Once all 5,000 units are delivered, the condition is met, and its right to the 100 warrants becomes unconditional. At this point, the company derecognizes the contract asset and applies other guidance (like Topic 321 or 815) to account for the warrants it now holds.

Effective Date & Transition: When and How? 🗓️

So, when do you need to start applying these new rules?

- Effective Date: The amendments are effective for all entities for annual reporting periods beginning after December 15, 2026, and interim periods within those years.

- Early Adoption: Can’t wait? Early adoption is permitted. However, if you adopt one part of the ASU early, you must adopt the other part at the same time.

- Transition Methods: You have a choice on how to adopt the changes. You can elect a different method for the derivative rules (Issue 1) and the revenue rules (Issue 2).

- Prospective Approach: Apply the new rules only to new contracts entered into on or after the adoption date.

- Modified Retrospective Approach: Apply the rules to existing contracts as of the beginning of the adoption year by recording a one-time cumulative-effect adjustment to the opening balance of retained earnings.

Key Takeaways from ASU 2025-07

Frequently Asked Questions ❓

This latest update from FASB is a positive step toward more practical and principle-based accounting. By refining the scope of derivative accounting and clarifying the rules for revenue contracts with share-based payments, ASU 2025-07 should help many organizations save time and reduce complexity. It’s a great time to review your existing contracts and accounting policies to see how you’ll be affected. If you have any more questions, feel free to ask in the comments~ 😊