The GAAP Gap: Why US Accounting Rules Are a Challenge for Japanese Companies

Have you ever felt like you’re speaking a different language at work? That’s exactly what many Japanese companies are experiencing with their U.S. operations, but in the world of accounting. It’s something called the “GAAP gap,” and it’s causing some major headaches. If you’re involved in international business, this is a topic you’ll definitely want to understand. Let’s break it down together! 😊

What is this “GAAP Gap”? 🤔

In simple terms, U.S. companies follow a set of rules called the Generally Accepted Accounting Principles (GAAP). Japan has its own version, often called J-GAAP. While they might sound similar, the differences can be huge! This creates a “GAAP gap” for Japanese parent companies trying to manage their American subsidiaries. According to a recent analysis from KPMG, this gap is putting companies at risk of serious penalties from the U.S. Securities and Exchange Commission (SEC).

The core of the problem is a lack of expertise. There’s a global shortage of accounting professionals who are fluent in both US GAAP and Japanese business practices. This makes it incredibly difficult for Japanese subsidiaries in the U.S. to stay compliant, leading to a stressful and costly dual reporting burden where they have to maintain two separate accounting systems.

The “GAAP gap” isn’t just a technical issue; it’s a strategic one. Failing to bridge this gap can impact a company’s credibility in U.S. capital markets and lead to significant financial penalties.

Key Challenges and Hot Spots 📊

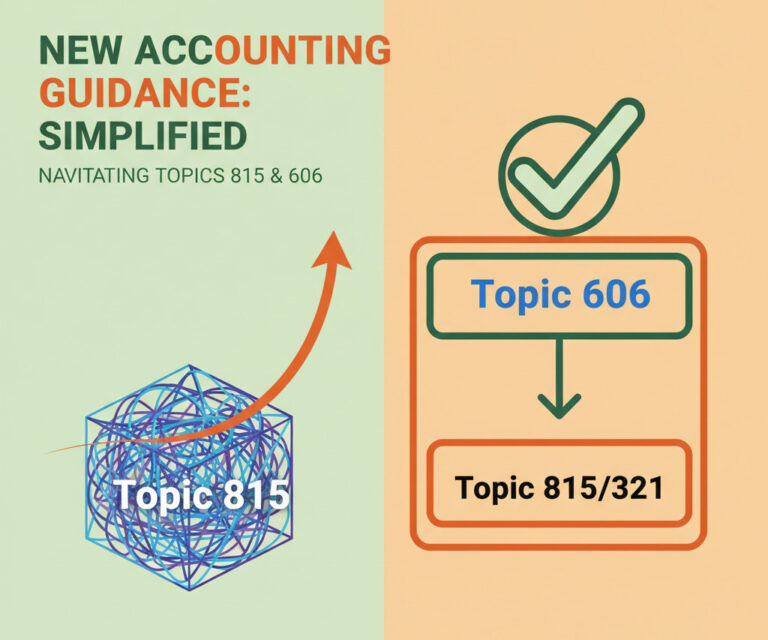

So, where are companies feeling the most pressure? One of the biggest culprits is the new lease accounting standard, ASC 842. This rule changed everything by requiring almost all leases to be recognized on the balance sheet—a major departure from the off-balance-sheet treatment common in Japan.

The SEC is watching this closely. They’ve been sending comment letters to companies with inadequate disclosures. For instance, Health Catalyst, Inc. had to formally amend its financial statements after the SEC requested more detailed information. Even huge players like Mitsubishi UFJ Financial Group (MUFG) have reported that preparing US GAAP statements takes nearly as much effort as their primary J-GAAP filings!

The shift of many Japanese parent companies to International Financial Reporting Standards (IFRS) adds another layer of complexity. This often forces their U.S. subsidiaries to manage IFRS reporting on top of US GAAP, further straining resources.

Systemic and Cultural Mismatches 👩💼👨💻

The challenges go beyond just different rules; they’re rooted in different business cultures and systems. Japan’s accounting systems are often built around historical valuation, while US GAAP frequently requires fair-value recognition. For example, J-GAAP might record non-listed securities at their original cost, whereas US GAAP demands they be valued at their current market price. This fundamental difference requires a completely different approach to data management and asset valuation.

To overcome these mismatches, companies must do more than just hire consultants. The long-term solution involves building internal capacity, overhauling legacy systems, and developing deep, in-house US GAAP fluency.

Conclusion: Key Takeaways 📝

Navigating the complexities of US GAAP is no longer optional for Japanese multinationals; it’s a critical strategic imperative. Here are the key points to remember:

- The “GAAP Gap” is Real: Significant differences between US GAAP and J-GAAP create compliance risks and operational burdens.

- Talent is Scarce: There is a major shortage of bilingual accounting professionals with US GAAP expertise, making it hard to manage compliance effectively.

- ASC 842 is a Major Hurdle: The new lease accounting standard is a primary source of compliance challenges and SEC scrutiny.

- Invest in Internal Capacity: Relying solely on external help is a short-term fix. The best strategy is to build in-house expertise and modernize accounting systems.

Bridging the GAAP Gap

Frequently Asked Questions ❓

I hope this helps demystify the “GAAP gap”! It’s a complex topic, but understanding the basics is crucial for anyone in the global business arena. If you have any more questions, feel free to ask in the comments~ 😊