Retirement Plan 101: Your Complete A-to-Z Strategy for Financial Freedom

Ever get that late-night feeling of anxiety, wondering if you’ll have enough money to live comfortably when you stop working? You’re definitely not alone. The world of retirement planning can seem like a maze of confusing acronyms and complicated rules. It’s easy to feel overwhelmed and put it off for “later.” But here’s the good news: creating a solid retirement plan is one of the most empowering things you can do for your future self, and it’s more achievable than you think! Let’s walk through it step-by-step. 😊

The Building Blocks: Types of Retirement Accounts 🏦

Think of these accounts as special “baskets” for your investments that the government rewards you for using with amazing tax benefits. The two most common personal accounts are Individual Retirement Accounts, or IRAs.

Traditional IRA vs. Roth IRA

The main difference comes down to when you pay taxes. With a Traditional IRA, you contribute pre-tax money, which can lower your taxable income today. Your money grows tax-deferred, and you pay income tax when you withdraw it in retirement. With a Roth IRA, you contribute after-tax money, so there’s no immediate tax deduction. However, your money grows completely tax-free, and qualified withdrawals in retirement are also tax-free!

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Tax on Contributions | Tax-deductible (Pay less tax now) | Not deductible (Pay tax now) |

| Tax on Withdrawals | Taxed as ordinary income | Tax-free (if qualified) |

| Income Limits | No, but deduction may be limited | Yes, for direct contributions |

| Required Minimum Distributions (RMDs) | Yes, starting at age 73/75 | No, for the original owner |

Employer-Sponsored Plans: The Mighty 401(k)

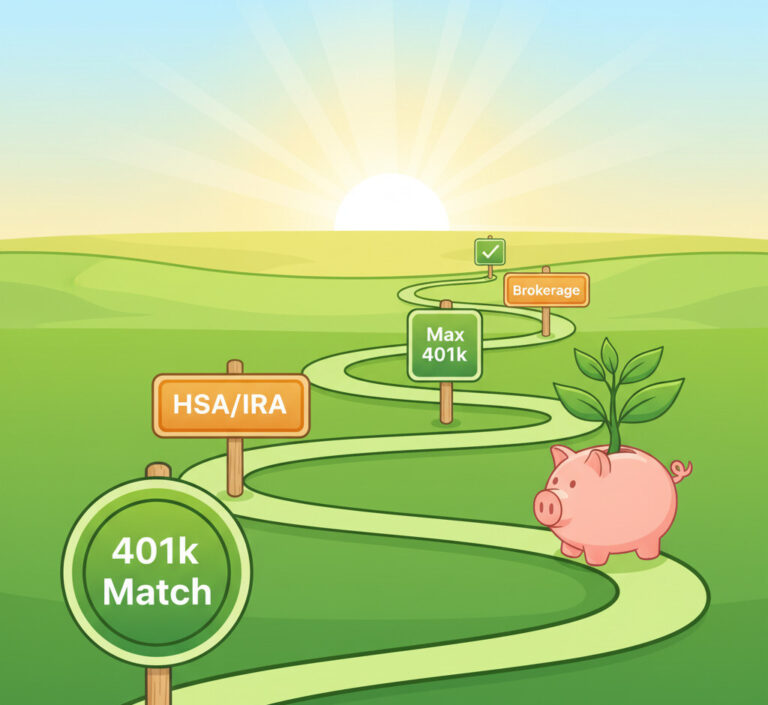

A 401(k) is a retirement plan offered by your employer. It allows you to save a portion of your paycheck, and many companies offer a “match.” This is a huge deal—it’s essentially free money! For example, your company might match 100% of your contributions up to 4% of your salary. If you’re not contributing at least enough to get the full match, you’re leaving a guaranteed return on the table.

The Health Savings Account (HSA) is a secret superhero of retirement planning. If you have a High-Deductible Health Plan, you can use an HSA. It offers a triple tax advantage: your contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are tax-free! After age 65, you can withdraw money for any reason, and it’s just taxed like a Traditional IRA.

Smart Strategies for a Secure Future 🎯

Once you have the accounts, you need a game plan. Understanding a few key concepts can make a world of difference in how much your savings grow and how long they last.

The 4% Rule: A Guideline for Withdrawals

This is a popular rule of thumb to help you figure out how much you can safely withdraw from your portfolio each year in retirement without running out of money. The idea is to withdraw 4% of your total savings in your first year of retirement and then adjust that amount for inflation in subsequent years.

📝 Example of the 4% Rule

- Your retirement portfolio: $1,000,000

- Year 1 withdrawal: $1,000,000 × 4% = $40,000

- Year 2 (assuming 2% inflation): $40,000 × 1.02 = $40,800

This strategy aims to make your money last for at least 30 years, assuming a balanced portfolio of stocks and bonds.

A common mistake is simply putting money into a retirement account and leaving it as cash. You must invest the funds within the account! Whether it’s in stocks, bonds, mutual funds, or ETFs, your money needs to be working for you to grow over the long term.

Generating Income in Your Golden Years 💰

The goal of all this saving is to create reliable income streams when you’re no longer working. Beyond your investment portfolio, there are a few other key sources to consider.

- Social Security: This is a government benefit you’ve paid into throughout your working years. You can start claiming as early as age 62, but your monthly benefit will be permanently reduced. Waiting until your full retirement age (around 67) or even until age 70 will significantly increase your monthly payments.

- Annuities: An annuity is a contract with an insurance company that can provide you with a guaranteed income for life. It’s a way to turn a lump sum of your savings into a predictable “paycheck,” which can be a great way to cover essential expenses and reduce the fear of outliving your money.

- Real Estate: For some, rental properties can provide a steady stream of passive income. While it requires management, it also comes with tax benefits like depreciation and can be a powerful wealth-building tool.

Retirement Plan Key Takeaways

Frequently Asked Questions ❓

Building a retirement plan is a journey, not a destination. By taking these steps, you’re building a foundation for a future where you have the freedom to enjoy life on your own terms. If you have any questions or want to share your own tips, please drop a comment below! 😊