US GAAP vs IFRS Ch.2: Consolidation & Investment Accounting

Ever found yourself staring at two sets of financial statements for what looks like the same company, but the numbers don’t quite match up? You’re not alone! Navigating the world of global accounting can feel like learning two similar but distinct dialects. The two main players are, of course, US Generally Accepted Accounting Principles (US GAAP) and International Financial Reporting Standards (IFRS). While they share a lot of common ground, the differences can be significant, especially when dealing with complex areas like company acquisitions and investments. This post will be your friendly guide to understanding these crucial distinctions. 😊

Consolidation: Who’s in Control? 📊

At its core, consolidation is about combining the financial statements of a parent company and its subsidiaries into one set of financials for the entire group. Both US GAAP and IFRS agree that the key ingredient for consolidation is control. If a parent controls a subsidiary, it must consolidate it. Simple, right? Well, how they define and determine control is where things get interesting.

US GAAP uses a two-pronged approach. First, an entity is evaluated under the variable interest entity (VIE) model. A VIE is an entity where control isn’t necessarily tied to voting rights but to other contractual arrangements. If an entity isn’t a VIE, then the traditional voting interest model is used, which typically looks at who holds the majority of voting shares.

IFRS, on the other hand, streamlines this with a single control model for all entities. Under IFRS 10, an investor has control if it possesses three elements: power over the investee, exposure to variable returns, and the ability to use its power to affect those returns. This can lead to different consolidation conclusions. For instance, IFRS considers the concept of “de facto control,” where a large minority shareholder might have control in practice, a concept not explicitly present in US GAAP’s voting model.

| Feature | US GAAP | IFRS |

|---|---|---|

| Consolidation Model | Two models: Variable Interest Entity (VIE) and Voting Interest Model. | Single control model for all entities. |

| Potential Voting Rights | Generally not included in the voting interest model. | Considered if currently exercisable. |

| “De Facto Control” | Concept does not exist. Control is more definitive. | Acknowledged; a minority shareholder can have practical control. |

IFRS offers a handy exemption from preparing consolidated financial statements for some parent companies that are themselves subsidiaries. If the ultimate parent company publishes IFRS-compliant consolidated financials, the intermediate parent might be off the hook. US GAAP is generally stricter, especially for SEC registrants.

Joint Arrangements: Partners in Arms 🤝

What happens when two or more parties decide to control an activity together? This is where joint arrangements come in. Again, the terminology and accounting diverge. IFRS 11 splits these arrangements into two types:

- Joint Operations: Parties have direct rights to the assets and obligations for the liabilities of the arrangement. The investor accounts for its share of assets, liabilities, revenues, and expenses directly on its own books.

- Joint Ventures: Parties have rights to the net assets of the arrangement, usually through a separate legal entity. The investor must use the equity method.

US GAAP doesn’t have this explicit “joint operation” classification. It primarily refers to joint ventures, where investors typically apply the equity method. The determination under IFRS between a joint operation and a joint venture is critical because it dictates a completely different accounting approach right from the start.

A method called “proportionate consolidation,” where an investor includes its share of each of the venture’s assets and liabilities line-by-line, is strictly forbidden for joint ventures under IFRS. US GAAP also largely prohibits it, but allows it in very limited, specific industries like construction and oil and gas. This is a classic trap for the unwary!

Equity Method Investments: The Power of Influence 📈

When an investor doesn’t have control but can exert significant influence over an investee, they use the equity method. A common rule of thumb is that owning 20% or more of the voting stock creates a presumption of significant influence. While the basic mechanics of the equity method are similar, the devil is in the details.

One key difference is that IFRS requires an investor to make its accounting policies uniform with its associate’s policies for like transactions. If your associate uses FIFO for inventory and you use weighted-average, you’d need to adjust their numbers before applying the equity method. US GAAP generally doesn’t require this; you can often retain the investee’s accounting policies, especially if they are in a specialized industry.

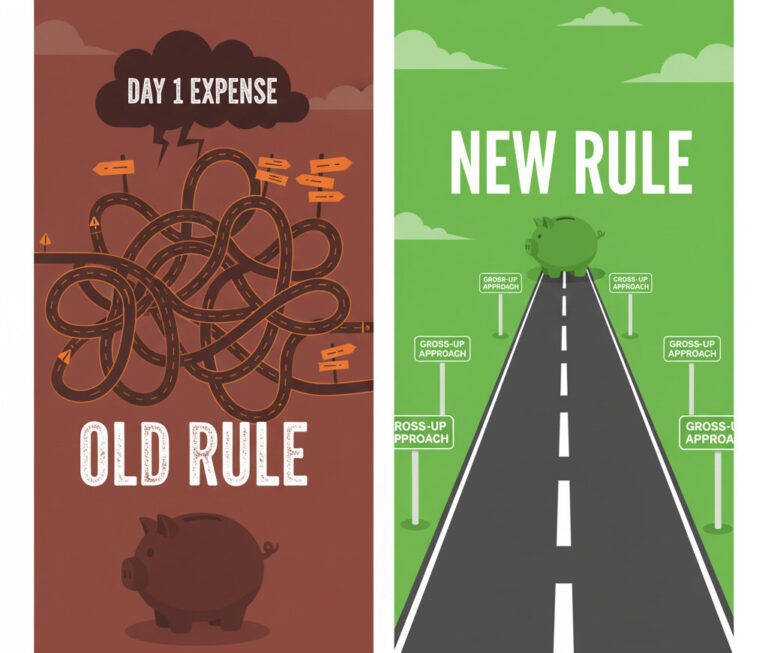

Furthermore, when determining significant influence, IFRS considers potential voting rights if they are currently exercisable, whereas US GAAP generally does not. Another interesting quirk: if you buy an associate for less than your share of its net fair value, IFRS requires you to recognize that bargain purchase as income immediately. Under US GAAP, this “negative goodwill” reduces the basis of the investment and is amortized over time.

US GAAP vs. IFRS at a Glance

Key Takeaways of the Post 📝

To wrap things up, let’s quickly recap the most important differences we’ve discussed:

- Consolidation Models: The biggest difference is US GAAP’s dual-model approach (VIE and Voting Interest) versus IFRS’s single, principles-based control model. This can lead to different entities being consolidated under each framework.

- Joint Arrangement Classification: IFRS requires you to classify a joint arrangement as either a joint operation or a joint venture, which has a major impact on the accounting. US GAAP’s approach is less differentiated.

- Equity Method Policies: Remember that under IFRS, you must conform the accounting policies of your equity method investee to your own. US GAAP is more flexible on this point.

- Principles vs. Rules: Broadly speaking, IFRS tends to be more principles-based, offering general guidelines, while US GAAP is often more rules-based, providing detailed, specific guidance for various scenarios.

Frequently Asked Questions ❓

I hope this guide has shed some light on the often-confusing world of US GAAP and IFRS. While the details can be technical, understanding the high-level differences is the first step to mastering global financial reporting. If you have any questions or experiences to share, please leave a comment below! 😊