<US GAAP vs IFRS> Ch 1. Principles, Practices, and Distinctions

Have you ever looked at a financial report from a company in Europe and felt like something was just a little… off? You’re not imagining things! Welcome to the world of global accounting, where the two main languages are US GAAP and IFRS. For investors, business owners, or anyone in finance, understanding the nuances between these two frameworks is crucial. It might sound complex, but don’t worry, we’re going to unravel it together. Let’s dive in! 😊

Shared Foundations: More Alike Than Different? 🤝

First, let’s get one thing straight: the similarities between US GAAP (United States Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) generally outweigh their differences. Think of them as two dialects of the same language. They are both global financial reporting frameworks built on the same foundational concepts. For many common business transactions, the accounting outcome will be identical under both systems.

Both frameworks are grounded in core principles like:

- Accrual Basis Accounting: This means transactions are recorded when they happen, not necessarily when cash changes hands. It provides a more accurate picture of a company’s performance.

- Materiality: Information is considered important (or “material”) if omitting or misstating it could influence the decisions of someone reading the financial statements.

- Consistency: This principle ensures that once a company chooses an accounting method, it sticks with it from one period to the next, allowing for meaningful comparisons over time.

The Big Debate: A Map vs. a GPS 🗺️

The most significant overarching difference lies in their philosophy. It’s often described as a “principles-based” versus a “rules-based” approach. Honestly, this is where most of the confusion comes from, so let’s use an analogy.

Imagine you’re on a road trip. IFRS is like a map. It shows you the destination, major highways, and key landmarks (the principles). It trusts you, as a professional, to use your judgment to figure out the best route to get there. This approach offers flexibility but requires significant professional interpretation.

On the other hand, US GAAP is like a GPS. It provides highly specific, turn-by-turn instructions (the rules) for almost every situation you might encounter. This approach aims for consistency and comparability by reducing the amount of judgment required. It’s much more detailed and prescriptive.

While this distinction is helpful, it’s not absolute. In some highly complex areas, like accounting for derivatives, both IFRS and US GAAP contain a significant amount of detailed guidance. The lines can get a bit blurry, so it’s best to think of it as a spectrum rather than two completely separate categories.

Where the Paths Diverge: A Closer Look 📊

Despite the shared foundations, the differences in philosophy can lead to very different results on financial statements. The significance of these differences really depends on the company’s industry, its specific transactions, and the accounting policies it chooses.

Here’s a table summarizing the key areas where these differences can have a material impact:

| Area of Difference | What It Means | Potential Impact |

|---|---|---|

| Level of Guidance | US GAAP provides much more detailed, industry-specific guidance. IFRS offers fewer specific instructions. | Companies under IFRS may need to develop their own accounting policies based on general principles. |

| Presentation | There are differences in how certain items are presented on the balance sheet, income statement, and cash flow statement. | Key financial ratios and metrics might not be directly comparable between two companies using different standards. |

| Measurement | The standards can differ on how assets and liabilities are measured (e.g., historical cost vs. fair value). | Can lead to significant variations in reported asset values and shareholder equity. |

| Policy Elections | Both frameworks allow for choices in accounting policies, but the available options can differ. (e.g., US GAAP allows LIFO for inventory, IFRS prohibits it). | This can affect earnings volatility, reported profits, and even tax liabilities. |

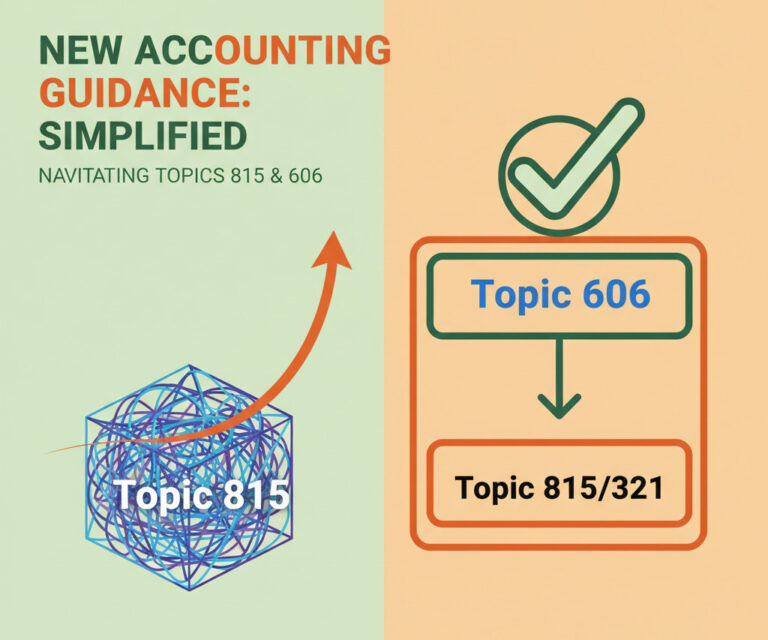

The world of accounting standards is not static! The standard-setting bodies, FASB (for US GAAP) and IASB (for IFRS), are constantly issuing new standards and amendments. This means that areas of convergence and divergence are always shifting. For professionals, continuous monitoring of these changes is absolutely essential to stay compliant and informed.

GAAP vs. IFRS at a Glance

Frequently Asked Questions ❓

Navigating the differences between US GAAP and IFRS is a key skill in today’s globalized economy. While they share a common foundation, their different approaches can lead to material impacts that every financial professional and savvy investor should understand. I hope this guide has helped demystify the topic for you! If you have any more questions, feel free to drop them in the comments below! 😊