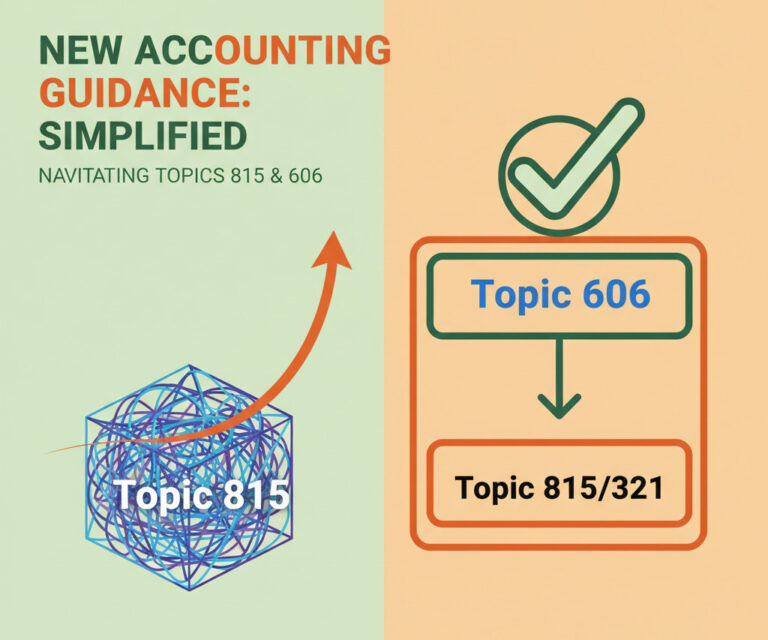

FASB Updates Government Grants Accounting: What Business Entities Need to Know

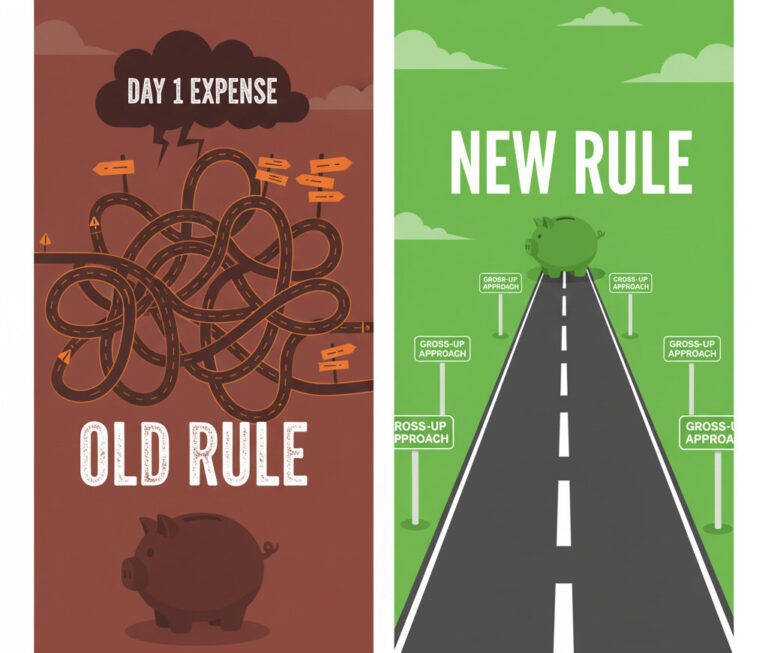

Finally, Clear Rules for Government Grants? Discover how the new FASB ASU 2025-10 changes the game for business entities, eliminating the guesswork of accounting for government assistance. To be honest, if you’ve ever had to account for a government grant as a business entity, you probably felt like you were navigating a maze without…