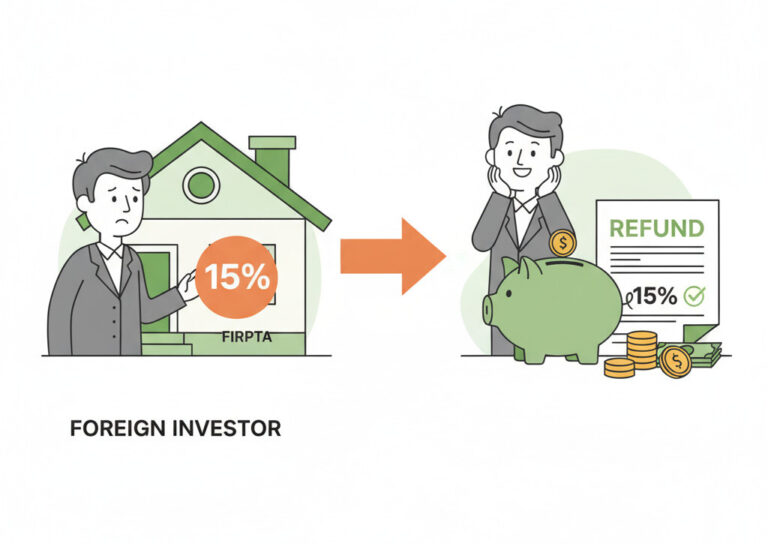

FIRPTA Withholding Isn’t a Tax: How to Get Your Money Back

Selling U.S. property as a foreigner? Don’t panic about the 15% FIRPTA “tax”! This guide breaks down what it really is, how to get a full refund, and how you can avoid this massive upfront withholding altogether. Imagine this: You’re a foreign investor, and you’ve made a smart move. You bought a U.S….