California Real Estate Withholding: The Complete Guide for Foreign Sellers

If you’ve ever dipped your toes into the California real estate market, you know it’s a beast of its own. But throw a foreign seller into the mix? That’s when things get really interesting. I’ve seen deals sailing smoothly toward closing only to hit a massive wall because no one paid attention to one specific detail: California Real Estate Withholding. 🏠

To be honest, it sounds scary. The word “withholding” makes everyone nervous. But here’s the good news: it’s usually just a misunderstanding of how the process works. Whether you’re a buyer, an agent, or a foreign seller trying to cash out on your investment, understanding these rules is the difference between a smooth payday and a nightmare with the Franchise Tax Board (FTB). Let’s break it down simply. 😊

Wait, Is This an Extra Tax? 🤔

This is probably the single biggest misconception I hear. People panic thinking the state is taking an additional chunk of money on top of everything else.

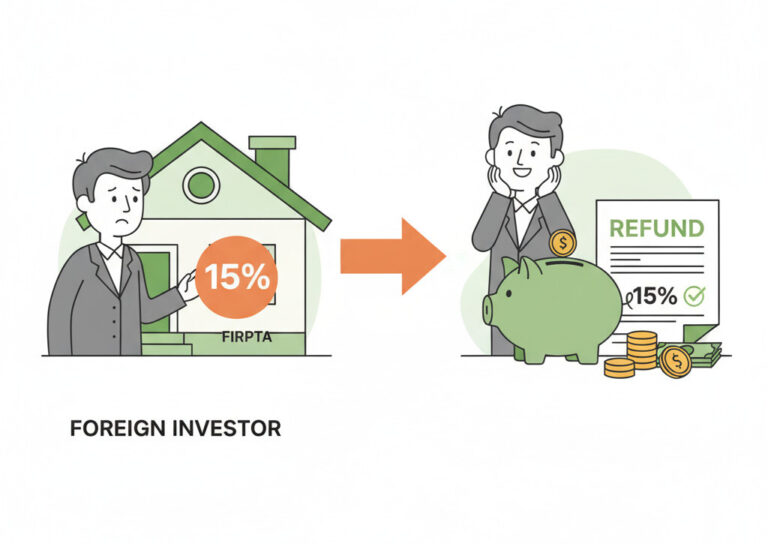

Let’s set the record straight: Withholding is NOT an extra tax.

Think of it more like a security deposit or a prepayment. California wants to make sure that once the property is sold and the money leaves the country, the income tax owed on that profit actually gets paid. So, during escrow, a percentage is set aside. It sits there as a credit until the seller files their state tax return. If you overpaid? You get a refund. Simple as that.

The money withheld is sent to the Franchise Tax Board (FTB) and acts exactly like estimated tax payments. It’s your money, just held in trust until tax time.

The Remitter: The Quarterback of the Deal 🏈

So, who is actually holding this money? In official state terms, this person is called the “Remitter” or “Withholding Agent.”

In 99% of standard real estate deals, this job falls to the Escrow Company. They are the neutral third party handling the cash and the paperwork. Their role isn’t just to shuffle papers; they have four distinct legal responsibilities:

- Notify: Tell everyone involved about the requirements (usually via Form 593).

- Verify: Check that the certifications and exemptions claimed are actually true.

- Withhold & Remit: Take the money out and send it to the state.

- Retain: Keep copies of all the paperwork.

The Verify step is where escrow officers have to be tough. If a seller claims the property was their “main home” to avoid withholding, but the escrow officer knows for a fact it was a vacation rental, they cannot accept that exemption. They are required to withhold the money.

The Magic Number: 3 1/3% 🧮

How much money are we actually talking about here? If you don’t want to get into complex math about your capital gains, the state has a default method that is super easy to calculate.

The default withholding amount is 3.33% (or 3 1/3%) of the Total Sales Price.

There is an alternative method where you calculate based on the actual profit (gain), which requires more paperwork. But for most straightforward transactions, people look at the sales price. Want to see what that looks like? Check out the calculator below.

🔢 Quick Withholding Calculator

Enter the total sales price of the property to see the estimated default withholding amount.

The “No ITIN” Dealbreaker 🚫

Here is where I see foreign sellers run into the biggest wall. There are legitimate exemptions to withholding. For example:

- The sales price is less than $100,000.

- The property is in foreclosure.

- The seller is a bank acting as a trustee.

However, if you want to claim any other exemption (like claiming a loss or zero gain), there is one non-negotiable requirement: A Taxpayer Identification Number (ITIN).

If the foreign seller does not have a valid ITIN by the time escrow closes, no exemptions are allowed. Period. Even if they lost money on the sale, the Remitter (escrow) is legally required to withhold the funds.

I can’t stress this enough: “No ITIN means No Exemption.” Preparation is absolutely key here.

What Happens If You Mess Up? (And How to Fix It) 🛠️

The stakes are high. If the Remitter fails to withhold when they should have, the state doesn’t just shrug. The Remitter can be held personally liable for the entire amount that should have been sent to the tax board. That’s why escrow officers are so strict about this.

But what about the seller? If money was withheld and you want it back, it’s not gone forever. Here is the path to getting your refund:

| Step | Action Required |

|---|---|

| 1. Apply | Apply for an ITIN with the IRS immediately. |

| 2. Contact | Once you have the ITIN, inform the Franchise Tax Board so they can apply the withholding credit to your account. |

| 3. File | File a California Tax Return. Report the sale, claim the withholding as payment, and get your refund. |

Key Takeaways of the Post 📝

Dealing with foreign sellers in California requires checking a few extra boxes, but it doesn’t have to be a disaster.

- Not a Tax: Withholding is a prepayment of potential future taxes, not a penalty.

- Escrow is Key: The “Remitter” (usually escrow) handles the notification, verification, and payment.

- The 3.33% Rule: The default withholding is 3 1/3% of the total sales price.

- No ITIN, No Luck: Without a Taxpayer ID at closing, mandatory withholding applies, regardless of exemptions.

- Deadlines Matter: Payments to the state are due by the 20th of the month following the sale.

Foreign Seller Withholding Recap

Frequently Asked Questions ❓

Navigating California’s withholding laws can feel like a maze, but if you ensure your escrow process is solid and your ITINs are in order, you’ll be just fine. If you have any specific horror stories or questions about this process, drop them in the comments below! 😊