Incorporate in Delaware: Is It the Right Choice for Your Startup?

If you’re starting a new company, especially a tech startup, you’ve almost certainly heard this piece of advice: “You *have* to incorporate in Delaware.” It’s said so often that it’s become a golden rule for entrepreneurs. But when you ask *why*, the most common answer you’ll get is, “Oh, it’s for the taxes. You’ll save a ton of money!”

I’ll be honest, I’ve heard this dozens of times. It’s one of those things that just gets repeated until everyone accepts it as fact. But is it actually true? Does creating a piece of paper in Delaware magically shield your California- or New York-based business from state taxes? As someone who’s navigated this exact question, let me tell you: it’s not that simple. In fact, that’s not the reason at all. Let’s dig in and find out what’s really going on. 😊

The Great Delaware Tax Myth 🤔

Alright, let’s tackle the big one right out of the gate. The idea that you incorporate in Delaware to reduce your *state income tax* is, to put it plainly, a myth. It’s probably the single biggest misunderstanding in the startup world.

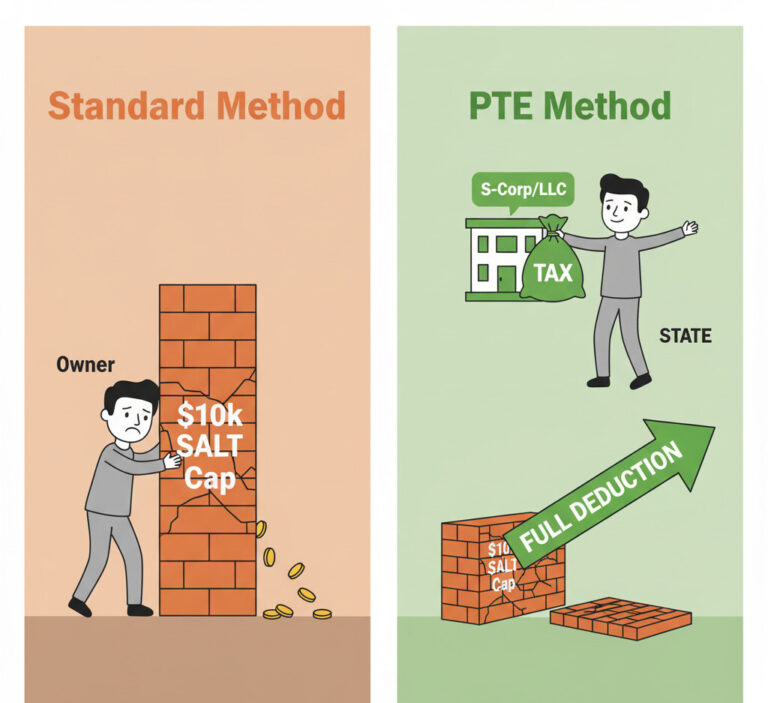

Here’s the key thing you have to understand: **state income taxes are based on where your business *activity* occurs, not where your company is incorporated.** This concept is often called “nexus.” If you have employees in California, if your office is in California, and if you’re making sales to customers in California, guess what? You’re doing business in California, and you will be paying California state income taxes.

Think of it this way: the state tax authorities don’t care about your company’s “birth certificate” (your articles of incorporation). They care about where you’re actually *earning money* and *using state resources* (like roads, infrastructure, and a local workforce). That piece of paper from Delaware doesn’t act as some kind of magic shield. It simply doesn’t change your income tax liability in the state where you actually operate.

Oh, and it goes without saying, this has absolutely zero effect on your *federal* taxes. The IRS taxes all U.S. corporations the same way, regardless of their state of incorporation.

This is a crucial distinction. While you *won’t* pay state income tax to Delaware (unless you actually operate there), you *will* have to pay an annual **Franchise Tax** just for the privilege of being a Delaware corporation. This tax is based on the number of shares you have. So, by incorporating in Delaware, you’re not replacing your home state’s tax; you’re actually *adding* another annual fee to your list of expenses.

So, Why IS Delaware So Popular? 📊

Okay, so if it’s not about saving on taxes, then what’s the deal? Why are more than a million businesses, including over 68% of all Fortune 500 companies and the vast majority of U.S. venture-backed startups, incorporated in this tiny state?

It all comes down to two major, and much more important, reasons:

- A Specialized Legal System: Delaware has a unique, business-focused court system that provides predictability and speed.

- An Investor-Friendly Framework: It’s the gold standard for investors, especially Venture Capitalists (VCs).

Let’s break those down, because *these* are the real reasons you need to understand.

A Haven for Corporations: The Power of Predictability ⚖️

This is the part that your lawyers absolutely love. Delaware isn’t just fast and efficient at filing paperwork; its true “secret sauce” is its entire legal ecosystem.

For over a century, Delaware has intentionally focused on being the leader in corporate law. The result is a massive, deep, and well-developed **body of corporate case law**. This means that for almost any corporate dispute you can imagine—a disagreement between founders, a lawsuit from a shareholder, issues during an acquisition—it’s likely already been litigated and ruled on in Delaware.

Why does this matter? **Predictability.** For a business, uncertainty is the enemy. In other states, a new or complex corporate lawsuit could be a total wildcard. In Delaware, lawyers can look at the vast history of case law and give you a much clearer, more predictable answer about the likely outcome. This saves time, money, and a whole lot of stress.

But the even bigger deal is *how* these cases are heard. Delaware has a special court called the **Court of Chancery**.

The Delaware Court of Chancery does not have juries. Let me repeat that: corporate lawsuits are not decided by a random group of peers who might be swayed by emotion. Instead, cases are heard by a “chancellor” (a judge) who is a highly experienced, specialized expert in corporate law. Their decisions are based on legal precedent and a deep understanding of complex business matters, leading to outcomes that are seen as more rational, consistent, and fair.

Here’s a quick comparison to make it clear:

Corporate Lawsuit: Typical State vs. Delaware

| Feature | Typical State Court | Delaware Court of Chancery |

|---|---|---|

| Decision-Maker | Often a jury of laypeople. | An expert judge (Chancellor). |

| Legal Basis | General laws, limited corporate case law. | Vast, 100+ year body of case law. |

| Primary Driver | Can be emotion, public opinion. | Legal precedent and facts. |

| Outcome | Highly unpredictable. | Highly predictable. |

A Magnet for Investors: The VC “Price of Admission” 💰

This is it. For 9 out of 10 tech startups, *this* is the single most important reason to incorporate in Delaware. It’s less of a choice and more of a requirement.

Here’s the bottom line: **Venture Capitalists (VCs) and other professional investors strongly prefer, and often *require*, their portfolio companies to be Delaware C-Corporations.**

If you walk into a VC meeting with a California LLC or a New York S-Corp and they decide to invest, one of the very first things their lawyers will tell you to do is to convert your company to a Delaware C-Corp. It’s not a negotiation; it’s just the price of admission to their world.

So, why do they insist on it?

- It’s the Industry Standard: Their lawyers know Delaware law inside and out. It’s what they’re comfortable with, and it’s what all their other investment documents are based on. It removes friction from the deal-making process.

- Flexible Corporate Structure: Delaware law is very flexible, making it easy to create complex capital structures. This is essential for VCs, who don’t just buy “common stock” like everyone else. They get “preferred stock” with special rights (like liquidation preferences, anti-dilution, etc.). Delaware law makes issuing and managing these different classes of stock very straightforward.

- Clear Rules on Rights: The well-established laws clearly define the rights and responsibilities of shareholders and the board of directors, which gives investors confidence.

By starting as a Delaware C-Corp, you create a smooth path for your entire funding journey. The process for your seed round, Series A, Series B, and so on, becomes a standardized, repeatable process. Everyone’s lawyers are “speaking the same language.” This standardization is also crucial for an eventual exit, whether it’s an Initial Public Offering (IPO) or an acquisition by a larger company.

Your Final Decision: Are You a “Delaware” Company? 🧭

We’ve busted the tax myth and covered the real, powerful reasons to choose Delaware. So, how do you make your final decision?

It’s not about taxes. It’s about **what kind of company you are building.** It’s an *identity decision*. You need to choose the path that matches your ambition and business model.

I’ve broken it down into two simple scenarios. See which one sounds more like you.

Scenario 1: Choose Delaware IF… 🚀

- You are a **tech startup** (or any high-growth-potential company).

- You plan to seek **VC funding** or raise money from angel investors.

- Your goal is **rapid scaling** across the US or globally.

- You plan to offer **stock options** to employees.

- Your long-term goal is an **IPO or acquisition**.

Scenario 2: Choose Your Local State IF… 🏠

- You are running a **family business, local service, or small business** (e.g., a restaurant, consulting firm, or coffee shop).

- You have **no plans to seek outside investors** (VCs or angels).

- Your operations are **simple and primarily local**.

- You prefer to keep paperwork and annual fees to a minimum (avoids the extra Delaware franchise tax).

For most of the people I talk to—founders of tech startups, whether they’re from Korea, California, or anywhere else, aiming to break into the US market—the choice is clear. If you’re playing the startup game and you need investor funding to grow, incorporating in Delaware from day one is the standard, necessary, and smartest choice.

Key Takeaways 📝

I know that was a lot of information, so let’s quickly recap the most important points to remember from this article:

- The Tax Myth is BUSTED: Incorporating in Delaware does **not** save you on state income taxes. You pay those where your business actually operates.

- Real Reason #1 (The Legal System): Delaware offers a highly predictable, fast, and expert legal system for corporate matters (the Court of Chancery), which uses expert judges instead of juries.

- Real Reason #2 (The Investor Standard): VCs and professional investors *require* startups to be Delaware C-Corps. It’s the “price of admission” for funding because it’s a flexible and standardized system their lawyers trust.

- Your Final Choice: The decision isn’t a tax strategy; it’s an **identity decision** about the *type* of company you’re building (a local business vs. a high-growth, venture-backed startup).

Why Incorporate in Delaware?

Frequently Asked Questions ❓

Now you know the real facts. Choosing where to incorporate isn’t some secret tax hack; it’s a foundational decision about your company’s identity and future. Now you can go and build that future on the *right* foundation.

What are your thoughts? Did this bust a myth you’d heard? If you have any more questions, feel free to ask in the comments~ 😊