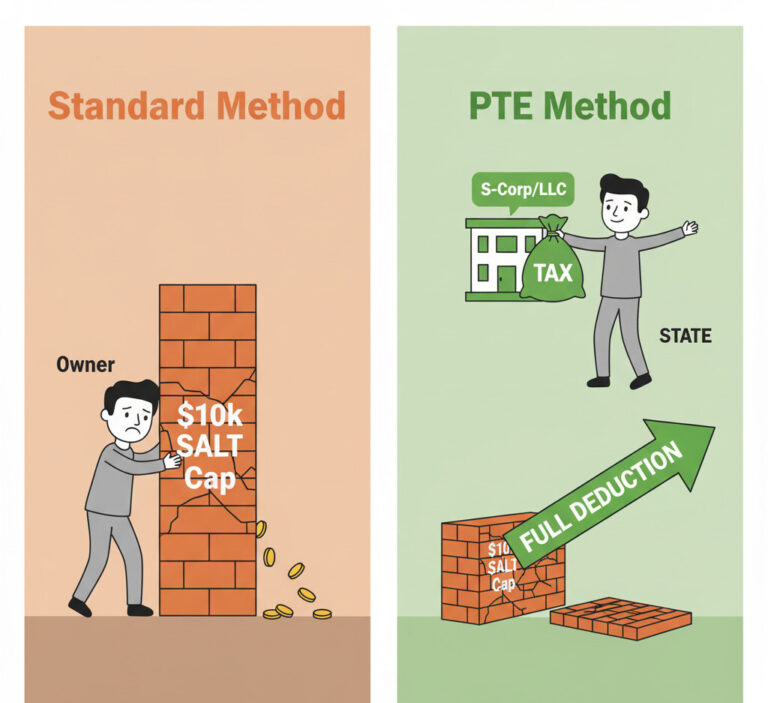

PTE Tax Election: The Ultimate S-Corp & LLC Strategy to Bypass the $10k SALT Cap

Frustrated by the $10,000 SALT Cap? Discover the powerful, temporary tax strategy that S-Corp and LLC owners are using to bypass this limit and potentially save thousands on their federal taxes. Are you a successful business owner, maybe running an S-Corp or LLC in a high-tax state like California, New York, or New…